Financial News

Share and discuss financial news articles from around the Web. For comments and experiences not tied to a specific linked article, create a discussion in the Miscellaneous section. If you have a question, please post it in the Ask the Community section.

Most Popular User Posts

All Financial News Articles

It now looks like once again rates will probably not be cut at the next Fed meeting thanks to the worsening inflation caused by Trump's read more

Has a 5.05% High Yield Checking up to $10,000. No debits required evidently. But as I read the information it seems to pay interest on the 40th read more

A survey of the best interest rates on: CDs, HYSAs, Rewards checking accounts, Treasury Bills, Money market mutual funds, Ultra-short Treasury ETFs, and Series I read more

If you didn't read the links to the bill, or listen to the debate this is part what you could have missed. Won't affect the people on this blog but it read more

VIENNA, Va.— Navy Federal Credit Union will no longer be required to refund $80 million to servicemembers over improperly charged overdraft fees, after the read more

WASHINGTON (Reuters) -The top U.S. watchdog agency for consumer finance this week canceled a $95 million settlement reached last year with Navy Federal Credit read more

The Federal Reserve said last week that household net worth decreased to $169.3 trillion in the first quarter of 2025. Household net worth was at a read more

Economist Peter Schiff issued warnings about America's economic trajectory during Wednesday's Federal Reserve meeting, predicting the central bank's decade-long read more

WASHINGTON—With similar arguments as another case that could upend long-standing legal precedent and redefine the limits of presidential power over independent read more

Fed Leaves Rates Unchanged For Now. (Let's see if the Banks/CUs hold off too, or if more keep slashing savings rates anyway for profit). NY Times: "Fed Sees Higher read more

Some people regret their decision to claim Social Security early, well before their full retirement age (FRA). Fortunately, a "do-over" option is available. It's read more

A survey of the best interest rates on: CDs, HYSAs, Rewards checking accounts, Treasury Bills, Money market mutual funds, Ultra-short Treasury ETFs, and Series I read more

The typical retirement age in 2024 was 64 for men, 62 for women. Up from 20 years ago. We’re working longer for several reasons: Americans are read more

Bottom LineIf you’re looking for an institution that puts your best interests first, gives you a say in how it’s run and offers competitive interest rates and fees, read more

A survey of the best interest rates on: CDs, HYSAs, Rewards checking accounts, Treasury Bills, Money market mutual funds, Ultra-short Treasury ETFs, and Series I read more

This article outlines a variety of low-risk investments and accounts (such as: CDs, money market funds, treasuries, agency bonds, bond mutual funds, and bond read more

A survey of the best interest rates on: CDs, HYSAs, Rewards checking accounts, Treasury Bills, Money market mutual funds, Ultra-short Treasury ETFs, and Series I read more

Start building smart savings habits for your future. Get tips for saving in your 20s and 30s and create a plan that works for you.

The Fed held interest rates steady before Trump reiterated his long-held view that the central bank should be lowering borrowing costs in a social media post late read more

Apple Federal Credit Union has agreed to a $2.5 million class action lawsuit settlement to resolve claims it charged unfair overdraft fees on ATM withdrawals and read more

This is not good since using the online system is actually more inefficient in my experience, especially when chasing those timely bank bonuses.

A survey of the best interest rates on: CDs, HYSAs, Rewards checking accounts, Treasury Bills, Money market mutual funds, Ultra-short Treasury ETFs, and Series I read more

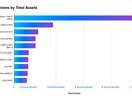

I knew NavyFed was the largest, but wow is it lopsided. For CUs, NavyFed is like Chase, Wells and BofA all rolled into one. And PenFed (Pen Fed? Who are they read more

I saw an email that someone wanted a link but was leaving the house for an appointment. Could not find the email now. This is a link I found but have not read it. read more

The FDIC wants to roll back a policy that had increased oversight into large bank mergers. The proposal unveiled by the Federal Deposit Insurance Corp.

The First has been recognized as the top-performing state bank in Pennsylvania by Bank Performance Report.