The Impact of the GOP Tax Bill on Savers

I’m very pleased to announce that Sol Nasisi will be a regular contributor to DepositAccounts. Many of you may be familiar with Sol from his time at BestCashCow where he is the co-founder and a past president. Last year Sol left BestCashCow and is now working on other projects. I was thrilled when Sol approached me with an interest in contributing to DepositAccounts. Sol will be writing a few articles a month on trends, news and issues that impact savers. I’m sure you will appreciate his analysis and insights that he has gained from his many years in the banking industry. Please join me in welcoming Sol Nasisi.

The Impact of the GOP Tax Bill on Savers

by Sol Nasisi

Ever since the 2008 financial crisis, savers have taken it on the chin with rock bottom interest rates. The Federal Reserve, in an effort to revive the economy, lowered the federal funds rate, deflating returns for savers and creating an almost decade-long spell of near 0% returns on savings and CDs.

Finally, in 2015 as the economy continued to grow, the Fed began to reverse its 0% interest policy and rates began to slowly rise. On Dec.13, the Fed announced the latest of its five rate hikes since 2015, raising the Fed Funds Rate to 1.50%.

Many have analyzed how the GOP tax bill will impact lending, real estate, and small businesses, but scant attention has been paid to savers. The good news for savers is that the GOP tax bill that is currently winding through Congress has the potential to further accelerate the economy, as least in the short-term, and quicken the pace of rate increases over the next year. Although savings and CD rates may not return to the 6% range anytime soon, the GOP tax bill on the whole provides upside potential for savers.

Key provisions that will have a significant impact on savers

The House and the Senate bills differ in several significant aspects but some of the key tenets are the same. Three provisions of the GOP tax bill will most impact savers.

Lower rates within the new tax brackets

Both the Senate and House tax bills aim to lower federal income taxes for many Americans. The House seeks to accomplish this by cutting the number of tax brackets to four (10%, 25%, 35% and 39.6%) versus the seven brackets today (10%, 15%, 25%, 28%, 33%, 35% and 39.6%). The Senate bill will keep the seven brackets but lower the rates to 10%, 12%, 22%, 24%, 32%, 35%, and 38.5%. Many, although not all, Americans will fall into lower rate tax brackets with either of these plans.

Individuals who put their money into savings or CD accounts must pay taxes on the income generated on their returns. Depending on whether the Senate or House plan is passed, a saver’s tax bracket could drop, reducing the tax they have to pay on any interest income earned on deposit products. A saver in the current 33% tax bracket who has $100,000 in a CD at 1.5% APY will pay $495 in taxes on their earnings. Under the new plan, using the House brackets, the tax bracket drops to 25% and the payment to $375.

Not huge money, but it’s still something. The bigger impact will come from the changes in the corporate tax rate and the repatriation rates.

Cuts the corporate tax rate to 20% from 35% today and lowers the corporate repatriation rate to 10% for cash and 5% for non-cash

These two provisions are lumped together because they both impact the business climate in the United States. Cutting the corporate tax rate increases the earnings of corporate America and we have already seen the effect of this on the stock market. Much of the stock market's movement over the last year has been based on the prospects of the tax plan. Markets and business sentiment are forward looking, and after the election the stock market began to price in a significant cut in corporate taxes. As markets and corporations looked forward to the cut, the economy, which had already been steadily growing, kicked into higher gear, and the stock market and interest rates responded.

The S&P 500 has surged ahead nearly 19% in the last 12 months and GDP growth accelerated to 3.3% in the third quarter, and 3.1% in the second quarter, the first two consecutive months of above 3% economic growth since April and July of 2014. The labor market was already extremely tight, with the unemployment rate at a 17-year low of 4.1%.

American companies have over $2.5 trillion in cash stashed abroad, a strategy that helps them avoid paying the 35% corporate tax. The tax bill will provide an amnesty tax rate of 10% on cash and 5% on non-cash to repatriate funds into the United States. Goldman Sachs analysts believe that at a 12.5% repatriation rate, $250 billion will be brought back into the economy and markets. This money could stimulate the economy via stock buybacks, dividend payouts, capital expenditures, M&A activity, and R&D.

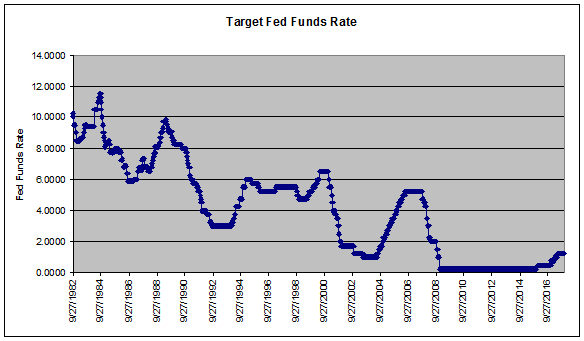

And stimulus certainly won’t hurt savers. Savings and CD rates are pegged to the Federal Reserve’s Federal Funds rate. As the economy accelerates, the Fed raises the Federal Funds to cool growth and prevent inflation. Conversely, when the economy is in recession or growing slowly, the Fed drops rates to try and stimulate the economy and increase growth. Faster growth over a period of time leads to a higher Federal Funds Rate and to higher Savings and CD rates.

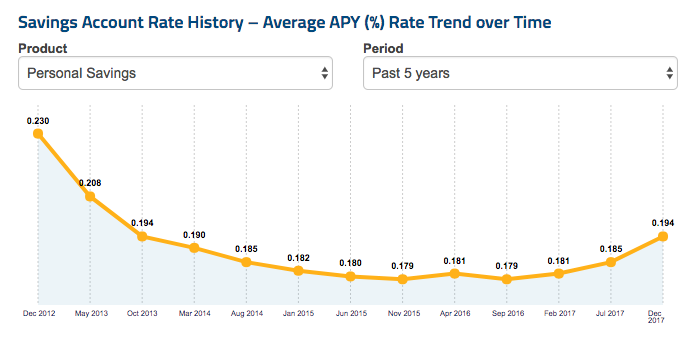

Since 2008 financial crisis, the Fed has kept the Fed Funds Rate at close to 0%, precipitating rock bottom rates on savings and CDs. But that started to change in 2015 as the Fed began lifting rates in response to a growing economy that had largely recovered from the financial crisis. The accelerating pace of economic growth over the past two years has prompted the Fed’s Open Market Committee to increase the Federal Funds Rate three times this year, raising the rate from 0.75% to 1.50%, the most recent increase coming on December 13. Savings and CD rates have risen in lockstep.

The tax plan could accelerate these rate increases

GOP lawmakers argue that the combination of cuts in corporate taxes, an increase in disposable earning from the cuts to individual tax rates, and the possible repatriation of some of the $2.5 trillion in cash could further stimulate the economy and force the Federal Reserve to accelerate the increase in the Federal Funds rate.

While the Fed does not endorse the Trump Administration’s belief that the tax cut will result in annual GDP growth over 3%, it does believe the tax cut will provide a “modest lift.” This means that for now, the Fed’s outlook for three additional Fed Funds increased in 2018 remains. As we have seen in the past with the housing bubble and the dotcom boom, The Fed is not omniscient.

Speaking to the Senate Banking Committee on Nov. 28, incoming Federal Reserve Chair Jerome Powell said, "We've been patient in removing accommodation and that patience has served us well...It's time for us to begin normalizing interest rates and the balance sheet."

This normalization could bring the Fed Funds rate up to 4-5% and savings and CD rates to the 6-7% range over the next 24 months. The chart below shows that in periods of high economic velocity, rates rose into the 4-6% range, and in the 1980s, even higher. How long they stay at the level depends on the future performance of the economy.

This is not to say that savers will benefit from all provisions of the plan. The GOP is still working on a compromise between the House version and the Senate’s proposed plan. The change in the tax brackets could sunset after 2025, raising rates back to the existing levels. Some individuals who make more than $200,000 would see their rate bracket increase according to the House plan. The plan could also eliminate deductions for education expenses, mortgage interest and some home mortgage interest deductions. And the plan is forecast to add more than $1 trillion to the deficit.

But for savers, the tax cut, if it spurs higher economic growth, will reinforce and accelerate already strengthening interest rates. Those who rely on the interest from savings accounts and CDs will see higher interest rates and lower taxes on that interest.

Go with online savings accounts

So, how’s the best way for a saver to play the forecast rise in rates? In a rising rate environment, it’s wise to avoid locking money into certificates of deposit. Instead, individuals should place money into high yield savings accounts. Online savings accounts often offer rates comparable to three and four year CDs and the rate will continue to rise along with interest rates.

If you do decide to open a CD, check the penalties for breaking the CD in case rates really shoot up and you want to get your money out. DepositAccount’s Early Withdrawal Calculator can help you determine if you should break the CD.

5 Easiest Bank Accounts to Open Online

5 Easiest Bank Accounts to Open Online What Is Bank Fraud? How to Recognize It, Avoid It and Report It

What Is Bank Fraud? How to Recognize It, Avoid It and Report It How to Open a Bank Account for a Minor

How to Open a Bank Account for a Minor How to Balance a Checkbook

How to Balance a Checkbook