Bluebird Prepaid Debit Card Review

When you’re in the market for a prepaid debit card, you want to get all the advantages of a traditional bank account without paying exorbitant fees. The Bluebird prepaid debit card from Walmart and American Express fits those requirements to a T — and then some.

With a Bluebird card, you won’t pay monthly or annual fees, you can transfer money and pay bills at no cost and you can sign up for free. An account also entitles you to benefits such as access to a savings account feature, plus perks and discounts through American Express. You can use your card any time and anywhere American Express is accepted without worrying about maintaining a minimum balance to avoid penalties.

Another big plus: Bluebird gives you multiple options for adding funds to your balance. The flexibility and range of American Express benefits make it a standout among prepaid debit cards.

Bluebird features

This card offers a low-cost alternative to traditional debit and credit card programs. It’s particularly attractive if you have a low credit score or limited credit history because there’s no credit check required. You will need to provide your Social Security Number for identity verification, but your credit score won’t be run. This also means that your account activity won’t be reported to credit bureaus, so this debit card won’t help you build credit.

As you’ll see in the fee chart in the next section, you can sign up for free online and add up to $500 to your account, which you can use right away. You can also buy a temporary card for $5 at Walmart. In either case, you’ll need to register online in order to get a personalized card, and your benefits will be limited until you’ve received and activated it.

Once you’ve activated your personalized card, you’ll be able to deposit up to $100,000 per year. You’ll also have access to the full range of account features, including:

- Direct deposit: As an account holder, you can set up direct deposit for your paycheck, tax return and government income, such as Social Security payments and Worker’s Compensation. Setting up employer direct deposit may give you access to your pay two days earlier than you’d otherwise receive it, depending on your company’s payroll processes.

- Family account options: You may add up to four family members to your account, allowing shared access to funds.

- Free transfers between Bluebird accounts: Account holders can send and request money from one another for free. Simply initiate a request or transfer through your online account or within the Bluebird app.

- Low-cost money transfers outside Bluebird: You can send up to $2,500 in cash to friends or family through Bluebird2Walmart Money Transfer remittance feature. You initiate the transfer from the website or app, and the recipient can pick it up at a designated Walmart store. The person to whom you send the money must be at least 18 years old, and he or she must provide a government-issued photo ID. Bluebird2Walmart transfers cost $4-16, depending how much money you send.

- American Express benefits: Since Bluebird is an American Express card, members are entitled to perks and discounts available to American Express credit card holders. These include fraud and purchase protection, roadside assistance, help with travel planning and issues and discounts on concert and event tickets.

- Amex Offers: You’re also eligible to sign up for Amex Offers, which are discounts and cashback deals from American Express and its retail partners. Offers change periodically, but they can include discounts at department stores, cosmetics brands, auto shops and restaurants, among others.

- Pay by card, digital transfer or check: In addition to money transfers and swipe payments, you can also write checks from your Bluebird account at no charge. A checkbook containing 40 checks costs $19.95 plus tax and shipping fees. Before you write a check, however, you’ll have to pre-authorize it online to ensure that it will clear.

- SetAside® Accounts: SetAside accounts are savings accounts you can create through Bluebird (although they yield zero interest). You can make one-time deposits or set up recurring transfers to ensure that you’re saving consistently.

- FDIC insurance: Any funds you deposit into your Bluebird personalized account are held in FDIC-insured custodial bank accounts. Money you put on your temporary card is not entitled to FDIC coverage. Moreover, these protections will not cover you if American Express becomes insolvent, because it is not a bank.

Bluebird Card fees and fine print

Bluebird promises no hidden fees, and we can confirm that the company is very transparent about its charges. Basic services such as direct deposit and bill pay are free, and any costs associated with adding or transferring funds are clearly spelled out on the website.

Note that direct deposits are capped at $100,000 a year. If you’re adding funds from your debit card, you’re limited to $200 per day or $1,000 per month. Cash reloads are restricted as well, to $2,500 per day and $5,000 per month. When you do a cash reload at a Walmart store, you can add no more than $1,999. While you can deposit checks through a mobile capture option, they must not exceed $5,000 in one day or $10,000 in a month.

|

|

|

|---|---|

| Activation fee | $0 |

| Reload fee | $0, except when adding cash at retailers other than Walmart ($3.95) or using the money in minutes mobile check capture option (up to 5% of the check) |

| Check deposit fee | $0 with 10-day option; up to 5% of the check amount if you want money immediately |

| ATM fees | $0 at MoneyPass ATMs; $2.50 + ATM owner fees at out-of-network machines |

| Card replacement fee | $0; $20 if you want to expedite shipping on a new card to replace the one that was lost, stolen, or damaged |

| Annual Fee | $0 |

| Monthly Fee | $0 |

| Overdraft fee | $0 |

| Transfer Fees to Bluebird accounts | $0 |

| Bill Pay Fees | $0 |

| Foreign Transaction fees | $0 |

Using the Bluebird mobile app

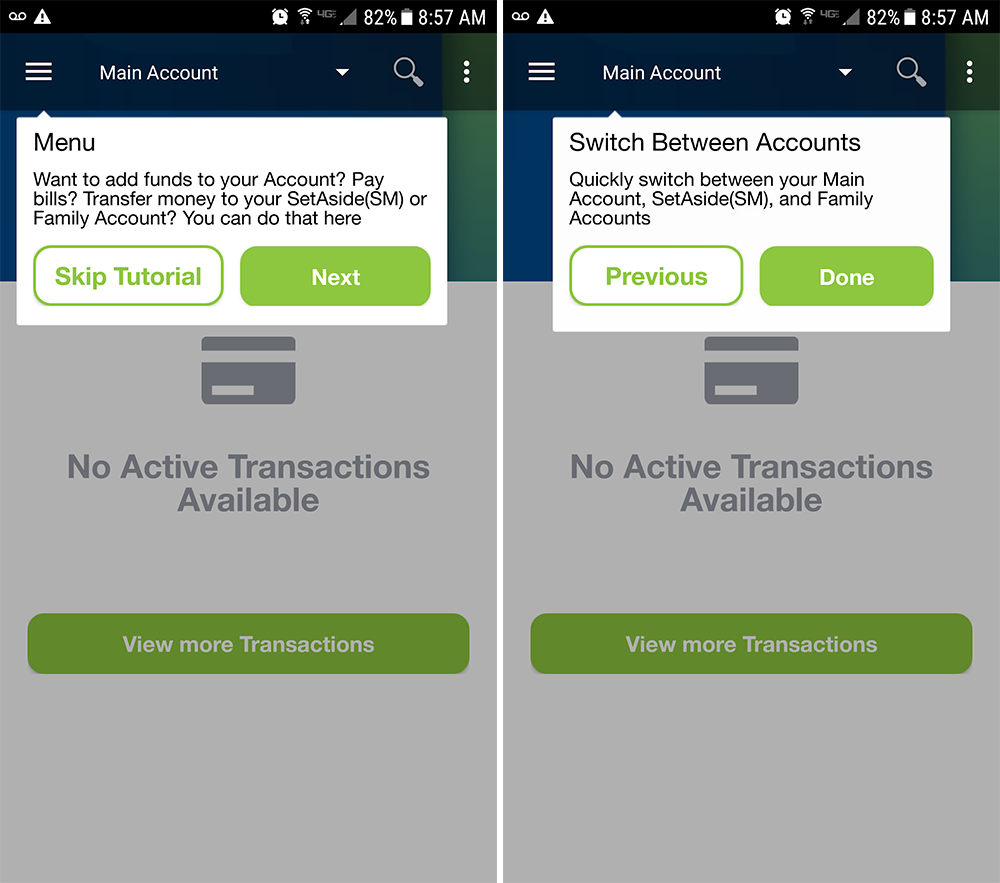

Available through the Apple App and Google Play stores, the mobile app provides a convenient way to manage your account. Like the online registration form, app setup takes under a minute. Simply download and log into the app, follow a brief tutorial and you’re all set.

The app home screen will show your current balance and recent transactions, giving insights into your account at a glance. A dropdown menu provides access to key features such as adding and transferring money, paying bills and initiating a cash pickup request. However, you must activate your personalized card before you can access these app features.

If you’re looking for an ATM, the app links to an external site at which you can search for nearby MoneyPass ATMs to avoid withdrawal fees. There’s also an option to search for out-of-network ATMs if no MoneyPass machines exist in your area.

The app is intuitive and user-friendly, and the simplicity of the design makes it quite functional for the card’s purposes. But it’s less sophisticated than financial apps that allow for budgeting and other money management features.

Opening a Bluebird account

If you’re a U.S. resident, are 18 and older and you have a Social Security Number, you can open an account — Bluebird is not available in Vermont, however. You can get started online by setting up your digital account username and password, as well as security questions and your ATM pin. The process takes under a minute, and you can read over the card terms and fees before submitting your information.

Once you’ve set up your account, you can add up to four people as family accounts. The only catch is that they must be 13 years or older. To use Bluebird, you and anyone added to the account will need to verify your email addresses before you can use the account.

Alternatively, you can buy a set-up kit at a Walmart store for $5. The kit includes a temporary card that you can use right away, but you’ll need to register online to receive your personalized card.

Overall review of Bluebird prepaid debit card

The Bluebird prepaid debit card’s low fees and minimal setup costs make it attractive if you need access to basic checking and savings functions and your credit history prevent you from opening a traditional bank account. Being able to include family members on the account provides a nice way to make joint financial decisions, save for shared goals and teach teens about money management.

What Is Bank Fraud? How to Recognize It, Avoid It and Report It

What Is Bank Fraud? How to Recognize It, Avoid It and Report It How to Open a Bank Account for a Minor

How to Open a Bank Account for a Minor How to Balance a Checkbook

How to Balance a Checkbook Retirement Savings: How Much Should I Save Each Month?

Retirement Savings: How Much Should I Save Each Month?