Large Banks vs. Small Banks – Who Offers the Better Rates?

A year and a half ago, we focused our data microscope on a question that comes up from time to time: do smaller or larger financial institutions offer better deposit rates? Or maybe it’s the mid-sized banks and credit unions? Our test hypothesis was what most savvy savers will anecdotally tell you from their rate shopping, that the biggest players typically pay the least. And indeed our 2015 analysis bore that out. But does that equate to the smallest institutions paying the most?

Since we last sharpened our pencils on this, two Fed rate hikes have injected a little upward movement across the deposit market, so we’ve been curious to revisit the question with fresh 2017 data. Join us to see what we found in our dive.

Setting the table

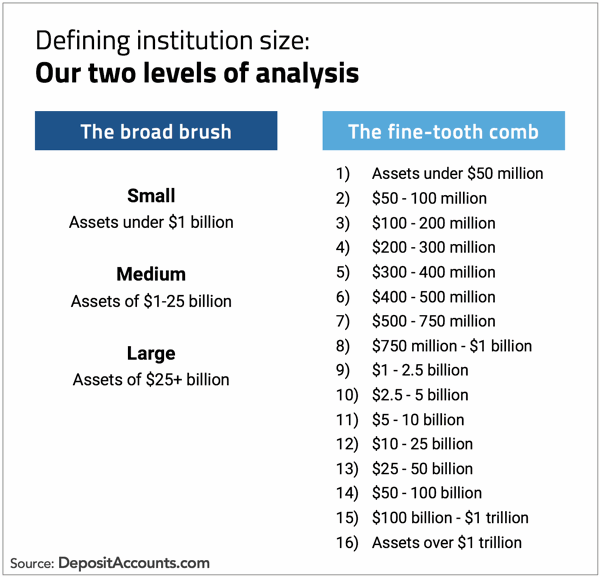

We started by choosing four deposit products to compare: personal savings and money market accounts, personal checking accounts, 1-year CDs, and 5-year CDs, all with a deposit amount of $1,000. Then, in defining some buckets for institution size, we decided to take it to two levels. First we applied a broad-brush approach of grouping asset levels into small, medium, and large tiers. Then we got more granular, breaking institutions into 16 finer-toothed asset categories.

As for which institutions to target, all banks and credit unions with a brick-and-mortar presence were included. We opted to leave out internet-only banks to give us the most apples-to-apples comparison among similar institution types, since their typically higher rates tend to skew analyses.

What we learned about small vs. medium vs. large

Running the numbers did indeed produce some interesting results on correlation between institution size and deposit rates, among all four of the products. First, you can see the differences for checking and savings accounts (aka, liquid accounts) in the chart below.

Small and medium institutions essentially competed neck-and-neck in these products. But the largest players? For both checking and savings accounts, their rates were just half of what their smaller counterparts were offering.

For 1-year and 5-year CDs, the story is similar. Big banks and credit unions pay far less than smaller players, although not as bad as half the rate. But here, medium institutions outshine the small ones, leading the returns for both certificate maturities.

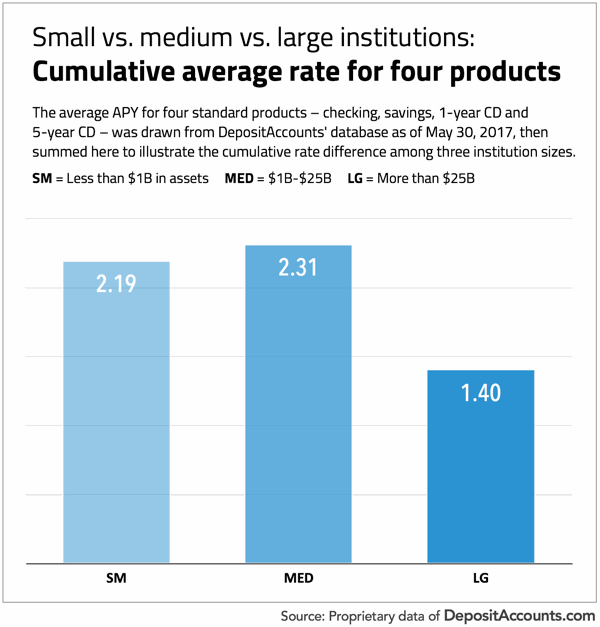

As one last test of how these size tiers compare across the full spectrum, instead of individually for the four products, I calculated a cumulative average rate. In essence, I imagined a basket holding one savings account, one checking account, one 1-year CD, and one 5-year CD, and assumed the average APY for each. I summed the four average rates into a single cumulative APY to see how much the three bank tiers vary when considering all four product yields as a bundle.

We see that, at this three-category level, medium-sized institutions win “all-around” honors for best returns across the menu of products. Also noteworthy is that the large institutions have a combined rate that is 35-40 percent lower than what the smaller players offer.

Drilling deeper: 16 size buckets

As we mentioned, we also took a fine-tooth comb to the institution sizes, so we could get a more detailed look at how rates vary across more precise asset groupings. Let’s start with the savings and checking accounts.

You’ll remember that the average APYs for small versus medium-sized institutions was very close for both checking and savings accounts: either the same or within an insignificant basis point. But when we break it down into smaller categories, this line graph shows that those rates are truly averages, meaning the rates at different sizes within the three large groupings are up and down quite a bit.

For savings accounts, medium-sized institutions with $5-10 billion in assets as a group have the highest average rate, but it then plummets for medium players in the next tier, $10-25 billion in assets. We also see that some of the large institutions pay more than this highest tier of the medium group.

Among checking account rates, averages bob up and down as you move from the smallest institutions to the mid-range, but the general trend is downward as size increases, with the highest rate averages indeed coming from the three smallest-size institutions at the far left.

For both types of liquid accounts, by the time you reach institutions with assets of $100 billion or more at the far right of the graph, rates have tanked to near zero.

So how do CD rates fare in this granular breakdown? The trends are a little more uniform here, as we compare 1- and 5-year CD returns. From the smallest tier at the left, both sets of average rates climb fairly steadily until they reach a peak with the banks and credit unions having $5-10 billion in assets. Note that this size tier is the same one in which savings rates peaked.

After the $5-10 billion institutions, rates plunge downward at every larger tier for 5-year CDs, with all the highest tiers having a worse average rate than seen among every other size institution.

For 1-year CDs, the storyline varies a smidge. A downward trend is also observed after hitting the $5-10 billion asset level, but there is an anomaly to the decline at the large-size $25-50 billion tier, before then dropping off again.

The Outliers

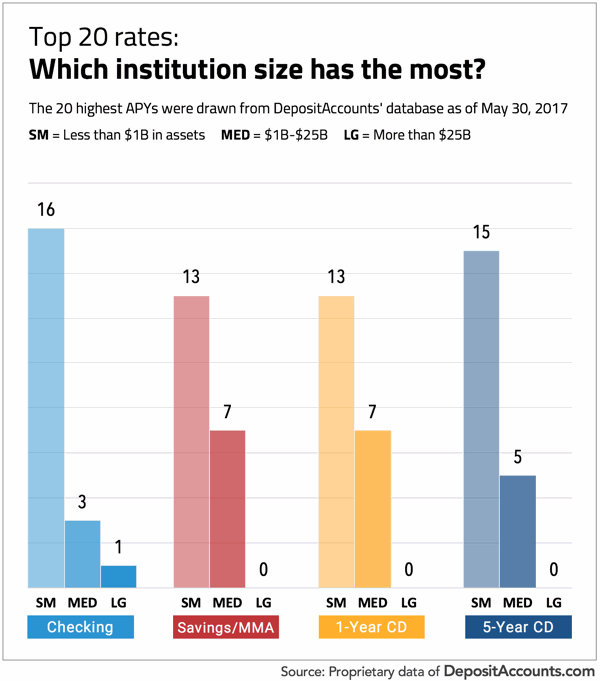

After compiling the data on average APYs across all institutions by size, we also wanted to explore the kinds of yields we know our smart rate-chasing readers find most worthy – namely, the top-drawer products. We analyzed these attractive outliers by searching DepositAccounts’ rate search tables for the 20 best individual yields for each product type. We then classified each of the 20 institutions according to the three broad-brush size categories.

The results from these most competitive rates paint a slightly different picture than what we found from averages across all banks and credit unions. What is still true is that the largest banks are the least likely to offer a competitive rate. In fact, out of 80 top rates (the best 20 from four products), only one comes from a large institution.

But this time, instead of the middle-range players standing out, small institutions dominated the top ranks of the nation’s best rates. Across the four products, 65 to 80 percent of the top APYs were offered by institutions with assets below $1 billion.

(Author’s note: Many of these top-rate products are not available to savers nationwide. Some bank products may only be available in certain states, while credit union rates are typically only available to savers who qualify for membership. To see what’s available in your state, visit our rate search tables.)

What to take away

Our analysis here is primarily intended as a test and documentation of how deposit rates correlate with the size of the institution offering them, and helps provide a fresh satisfaction to our perpetual curiosity about the topic here at DepositAccounts. But there are some practical takeaways as well.

First, while big banks may serve a useful purpose in the mix of financial institutions you use (e.g., local branch accessibility, ATM network, promotional bonuses), they are virtually never a good choice for stashing cash on which you’d like to earn a competitive return.

Second, don’t overlook the smaller players when looking for a place to earn top returns. Sure, maybe you’ve never heard of a bank in your state because it doesn’t have branches in your community. But by checking that the institution is either FDIC or NCUA insured, you can feel comfortable capitalizing on chart-topping rates from smaller banks and credit unions.

Finally, keep in mind that rates can change any time an institution opts to do so (barring rates you’ve locked in with a CD agreement or promotional guarantee). More rate hikes by the Fed could theoretically alter the landscape for players who become newly motivated to attract consumer deposits. On the flip side, as banks succeed, they grow and could find themselves in higher-sized tiers over time. As their deposit base increases, their incentive to offer competitive rates may diminish.

In any case, our rate-savvy readers know that shopping for the best returns is an ongoing exercise, since the rate environment can change, smaller banks can be acquired by larger banks, and special promotions can be announced at any time. But based on this data, our money is on your finding the vast majority of plum brick-and-mortar deals from the small- to medium-range players in the game.

Financial Planner vs. Financial Advisor: Is There a Difference?

Financial Planner vs. Financial Advisor: Is There a Difference? Step-Up CDs: What They Are and How They Work

Step-Up CDs: What They Are and How They Work What Is a Rollover IRA? Understanding Rollover Rules

What Is a Rollover IRA? Understanding Rollover Rules CD Early Withdrawal Penalty: Should You Pay It?

CD Early Withdrawal Penalty: Should You Pay It?