Is Your Bank Taking You to the Bank?

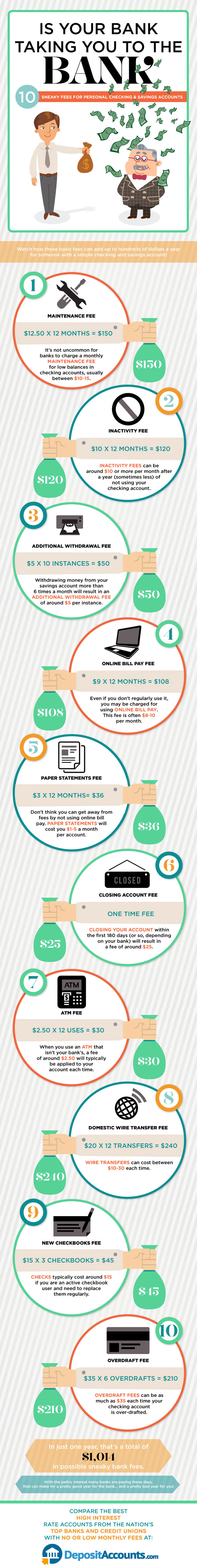

If you’re not careful with your checking and savings accounts, bank fees can surprise you. Before you know it, hundreds of dollars of your hard earned money may be lost to fees.

The first step to avoid surprises is to review the account documentation before opening an account. Some banks now offer a standardized and easy-to-read summary of account fees. If you don’t have time to read the full account disclosure, at least read this summary.

Once the account is opened, you should regularly monitor it. Banks are allowed to make fee changes as long as they provide notification. That notification often appears on the monthly statements. So it’s important to review your bank statement for any fee changes like an increase in the minimum account balance that’s required to avoid a monthly service fee. Also, it’s a good idea to make use of online banking. Regularly logging into your online account will allow you to quickly catch new fees.

Banks will sometimes blame government regulation for certain fees. One example is the excessive withdrawal fees. Federal regulation does require banks to keep the maximum number of certain withdrawals from savings accounts to six per statement period. However, some banks have limits even lower than six which could result in fees for fewer than six withdrawals in a month.

Financial Planner vs. Financial Advisor: Is There a Difference?

Financial Planner vs. Financial Advisor: Is There a Difference? Step-Up CDs: What They Are and How They Work

Step-Up CDs: What They Are and How They Work What Is a Rollover IRA? Understanding Rollover Rules

What Is a Rollover IRA? Understanding Rollover Rules CD Early Withdrawal Penalty: Should You Pay It?

CD Early Withdrawal Penalty: Should You Pay It?