Netspend Prepaid Debit Card Review

The Netspend prepaid debit card has transparent terms, reasonable fees and more than a few cardholder perks. Signing up for direct deposit is free and may help you get your paycheck up to two days early. The account comes with cashback rewards and an optional high-yield savings account. Consumers shopping for a no-fuss prepaid debit card account with early paydays should give this prepaid debit card a serious look. But be wary, since ATM fees and cash reload fees can be costly.

It’s important to understand that application verification and the initial funding process can take some time. In 2016, the Federal Trade Commission alleged Netspend made false claims about how quickly you can sign up for and use their card. Netspend touted “immediate access” to money, and that customers could “use it today” after signing up. In reality, there is an identity verification process that takes time before you get access to your cash. Some people were not able to meet the requirements and lost money.

As part of the FTC settlement, Netspend returned more than $10 million to customers. Netspend no longer makes claims on its website about guaranteed approvals or immediate access to money. The company’s fine print also explains that delays may occur until your information is verified. If you choose this prepaid debit card, don’t deposit money into the account until you’re certain the verification process is complete to avoid having a hold put on your money while your account is still under review.

Netspend prepaid debit card features

Using a Netspend prepaid debit card is straightforward: You load money on the prepaid card and then use the card to send money, pay bills, withdraw cash at ATMs and make purchases. Money can be uploaded to a Netspend card via cash, check and direct deposit. Here’s a rundown of the account features:

No credit check. Your credit and banking history isn’t reviewed to approve you for an account.

Two account options. Netspend offers a pay-as-you-go plan and a monthly plan.

- Pay-as-you-go plan: There is no monthly fee, but you pay for each card transaction. There’s a $1 fee per transaction when you hit “credit” at checkout and sign, while the fee is $2 for PIN transactions.

- Monthly plan: The monthly fee ranges from $5.95 to $9.95, depending on the card issuer, and there are no purchase transaction fees. The Netspend Premier Card is an exclusive monthly plan that offers 50% off your monthly fee. To qualify for the upgrade, you must receive direct deposits from payroll or government benefits totaling $500 within a calendar month. The Netspend Premier Card also comes with a Purchase Cushion that covers up to $10 in overdraft fees. The protection is not a credit line — your account will show a negative balance and the overdraft amount will be taken from your next reload.

Early access to your paycheck. Using direct deposit with Netspend may get you access to paychecks up to two days faster. Funds are released to you when the payment transaction is initiated, instead of when the transansation settles, which can result in an earlier deposit than you get with a bank. Direct deposits can be set up for tax refunds, government benefits, pensions and state unemployment benefits, among other things.

A savings account featuring 5.00% APY. The Netspend Savings Account is an optional feature. The first $1,000 you save in the account earns 5.00% APY. If you have more than $1,000 in the account, the first $1,000 still earns 5.00% APY while the amount that exceeds $1,000 earns 0.50% APY.

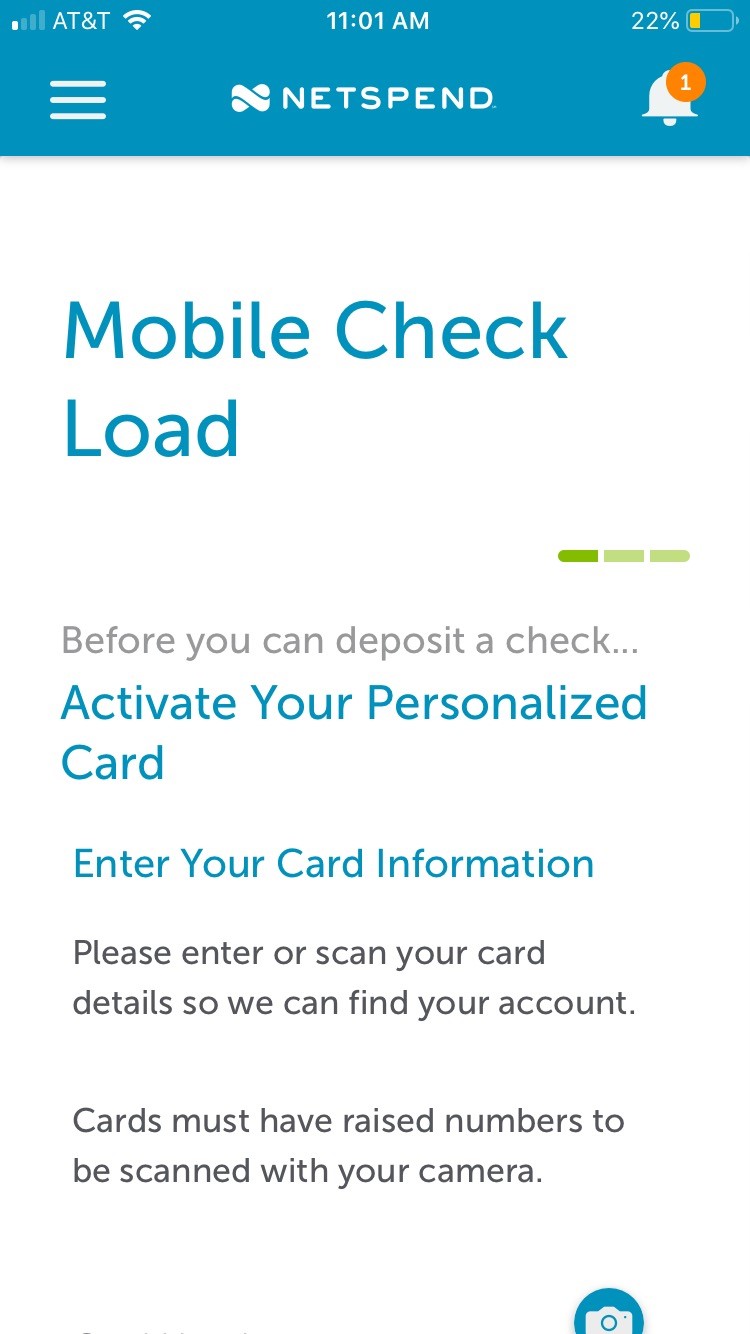

Remote check deposit. You can use the mobile app to deposit checks into your account.

In-person deposits available nationwide. Account holders can visit one of Netspend’s 130,000-plus reload locations across the U.S. to add cash or checks to the account in person.

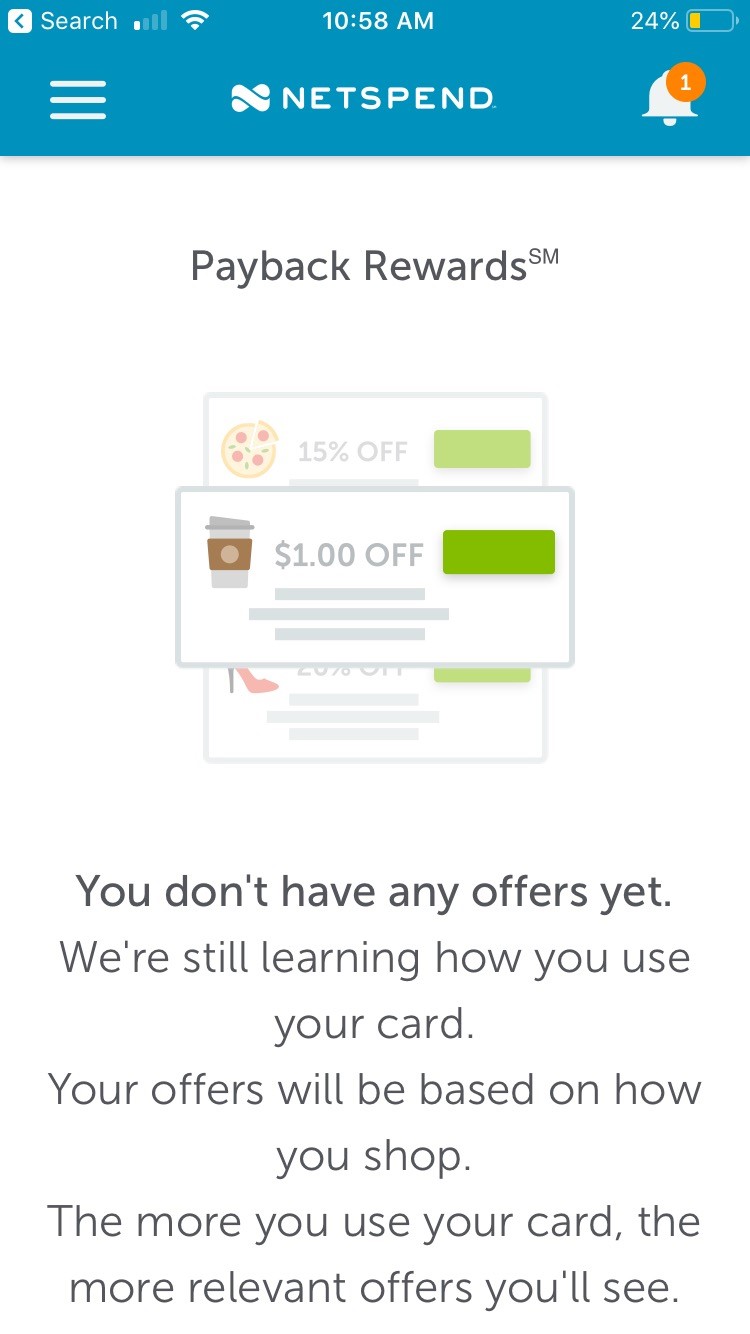

Rewards and referral bonuses. You may get alerts for cashback offers from time to time. Enrollment in the rewards program is automatic and offers show up on the app’s account dashboard. You and a friend can also earn a $20 referral bonus each time you refer someone new who opens an account and deposits at least $40.

Netspend fees and fine print

Netspend prepaid cards are issued by Axos Bank, MetaBank and Republic Bank & Trust Co. There’s no minimum balance required to open an account. Your account is insured through the bank issuer via the Federal Deposit Insurance Corp. (FDIC). Depending on the issuer, the card comes with Visa® Zero Liability or Mastercard® Zero Liability protection, which means you won't be held responsible for unauthorized charges made with your account.

It’s important to read through the terms of your offer before signing up. The Visa and Mastercard versions of the cards may have different terms and costs. For example, the Netspend® Prepaid MasterCard® may have a card purchase fee of up to $9.95 at retail locations, while there’s no purchase fee when signing up for the Netspend Visa Prepaid Card online.

Where fees are concerned, Netspend prepaid cards shine in some areas more than others. There’s no activation fee, which is a definite plus. You won't be charged for direct deposits or mobile check deposits. But the cash reload fees and ATM fees can cost you.

|

|

|

|---|---|

| Purchase fee | $0 for Visa card; third-party fee of up to $9.95 for Mastercards purchased at retail locations |

| Activation fee | $0 |

| Cash reload fee | Up to $3.95; varies by location and subject to change |

| Mobile check deposit fee | $0, although this is a third-party fee that can change |

| ATM fees | $2.50 plus ATM operator fees |

| Foreign transaction fee | 3.5% |

| Card replacement fee | $3.95 or $9.95 |

| Inactivity fee | $5.95 per month if there’s no activity (deposit, withdrawal, balance inquiry, etc.) within 90 days; if enrolled in monthly plan, this fee applies instead of monthly fee |

Using the Netspend mobile app

The mobile app is one of the top benefits of this account because of its capabilities. You can apply on the mobile app and you can use it to manage your account. Depositing checks and transferring funds can all be done with a few strokes of a finger.

Review transactions. The mobile app shows your account transactions, including your available balance and charges. Fees for the current month are calculated for you, as well as a running count of year-to-date fees.

Plan management. The fee plan section houses your cardholder agreement that outlines the fees. Here, you’re also able to switch plans and even upgrade to Netspend Premier if you’re eligible. (Remember, you need to have direct deposits totalling $500 in a calendar month to qualify.)

Manage rewards offers. In the rewards area of the app, you can check if there are any cashback offers available.

Remote deposit checks. The Mobile Check Load feature for remote check deposits is easily accessible in the app to deposit checks.

Enroll in savings and transfer money. You can enroll in the savings account to sock away up to $1,000 at a 5.00% APY. There’s no minimum balance required to open a savings account. Using the app, you can also initiate bank, PayPal and Western Union transfers.

Reload locations and customer service. You can look for reload locations in the app. If you have any questions about your account, call customer service seven days a week. There’s also a message portal in the app you can use to get in contact with Netspend.

Opening a Netsend account

Opening an account takes just a few minutes. You need to be at least to sign up for this account. Unfortunately, it is not open to residents of Vermont.

To apply, first head to the website or download the app. The app is free and available on the Apple App and Google Play stores. The application asks you to enter your name, birthdate, residential address and email address. Netspend may also ask for your government ID. This information is used to verify your identity. The final part of the application is choosing the prepaid card design.

Your credit is not pulled by the three credit bureaus or the ChexSystems, a database that reports on how consumers manage their deposit accounts. According to a Netspend spokesperson, “Netspend offers customers the ability to access our card programs regardless of their credit or financial history.”

After the application, the physical card will show up in the mail to activate within seven to 10 business days. As mentioned above, there’s no fee to activate the account, but there could be a fee to purchase the card if you buy it at a retail location.

Next, you can get started using the card. Loading the card with cash at a network location will cost up to $3.95. Withdrawing from the ATM costs $2.50, plus ATM operator fees. Swiping in the store will run you $1 for signature transactions and $2 for PIN transactions unless you upgrade to a monthly plan.

Overall review of Netspend prepaid debit card

The card perks are what make the Netspend prepaid debit cards stand out. The cards offer free check deposits, early paydays, cashback rewards and a high-yield savings account. Each of these perks bundled together is something you may not be able to find in other prepaid cards.

The monthly fee on the Netspend Monthly Plan of $9.95 is a bit higher than competitors that have fees in the $5.95 to $7.95 range. However, you do have the option to save 50% on this fee if you meet the guidelines for the Netspend Premier Card.

There are better prepaid debit cards for heavy cash and ATM users. Instead, consider the Navy Federal Credit Union GO Prepaid Card, which offers free in-network ATM withdrawals, or the American Express Serve® Free Reloads Card, which offers free cash reloads at select locations.

A Netspend prepaid debit card is best for people who don’t use cash frequently and who will benefit from free direct deposits and early paydays. Using check deposits will help you avoid the cash reload fee. If your monthly purchase transactions add up to more than the monthly fee, go ahead and sign up for the Monthly Plan so you’re paying one flat amount.

What Is Bank Fraud? How to Recognize It, Avoid It and Report It

What Is Bank Fraud? How to Recognize It, Avoid It and Report It How to Open a Bank Account for a Minor

How to Open a Bank Account for a Minor How to Balance a Checkbook

How to Balance a Checkbook Retirement Savings: How Much Should I Save Each Month?

Retirement Savings: How Much Should I Save Each Month?