Shopping Around for Best APYs Could Earn Americans $15,000+ More

The median transaction account balance in the U.S. was $8,000 in 2022, according to the Federal Reserve Survey of Consumer Finances (SCF).

Letting that money sit may be enough for many Americans. But those who keep their money in an account with a high annual percentage yield (APY) will certainly see that balance grow.

Just how much will it grow? According to the latest DepositAccounts study, balances could be boosted from 4.3% to 60.5%, depending on the account type and length of time.

Here’s a closer look.

- Key findings

- Shopping around for best APY could offer significant boost

- Savings accounts offer even greater boosts than checking accounts

- About 2 in 5 Americans search for better interest rates

- Most expect minuscule savings from switching accounts

- Majority of Americans stick to one bank

- Choosing new bank: Top expert tips

- Methodology

Key findings

- Shopping for the best APY on a checking account could boost your balance by 4.3% in a year and 51.9% in 10 years. This is based on a Jan. 16, 2025, analysis of checking account rates on DepositAccounts, with APYs ranging from 0.01% to 4.20% on certain deposits. With balances of $1,000 to $25,000, the difference between the lowest and highest checking account APY could result in an additional $43 to $1,067 in a year and $520 to $12,996 in 10 years.

- High-yield savings accounts generally provide higher APYs than checking accounts, leading to greater earning potential. By comparing rates and selecting the best APY, consumers could see their balance grow by 4.9% in a year and 60.5% over a decade. Our analysis identified 31 high-yield savings accounts with APYs exceeding 4.00%.

- A higher APY on a $25,000 balance over 10 years could lead to over $15,000 in extra earnings in your savings account. When considering returns from high-yield savings accounts, the difference between the lowest and highest APYs could lead to an extra $49 to $1,211 in one year or an additional $606 to $15,138 over 10 years. With inflation currently at 3.0% year over year, every dollar counts.

- 41% of Americans have searched for better interest rates on checking or savings accounts in the past year, a slight decrease from 43% in October 2022. Among Gen Zers, this rate spikes to 60%, while only 23% of baby boomers say the same. Further, 50% of men looked for better rates in the past year, versus 32% of women.

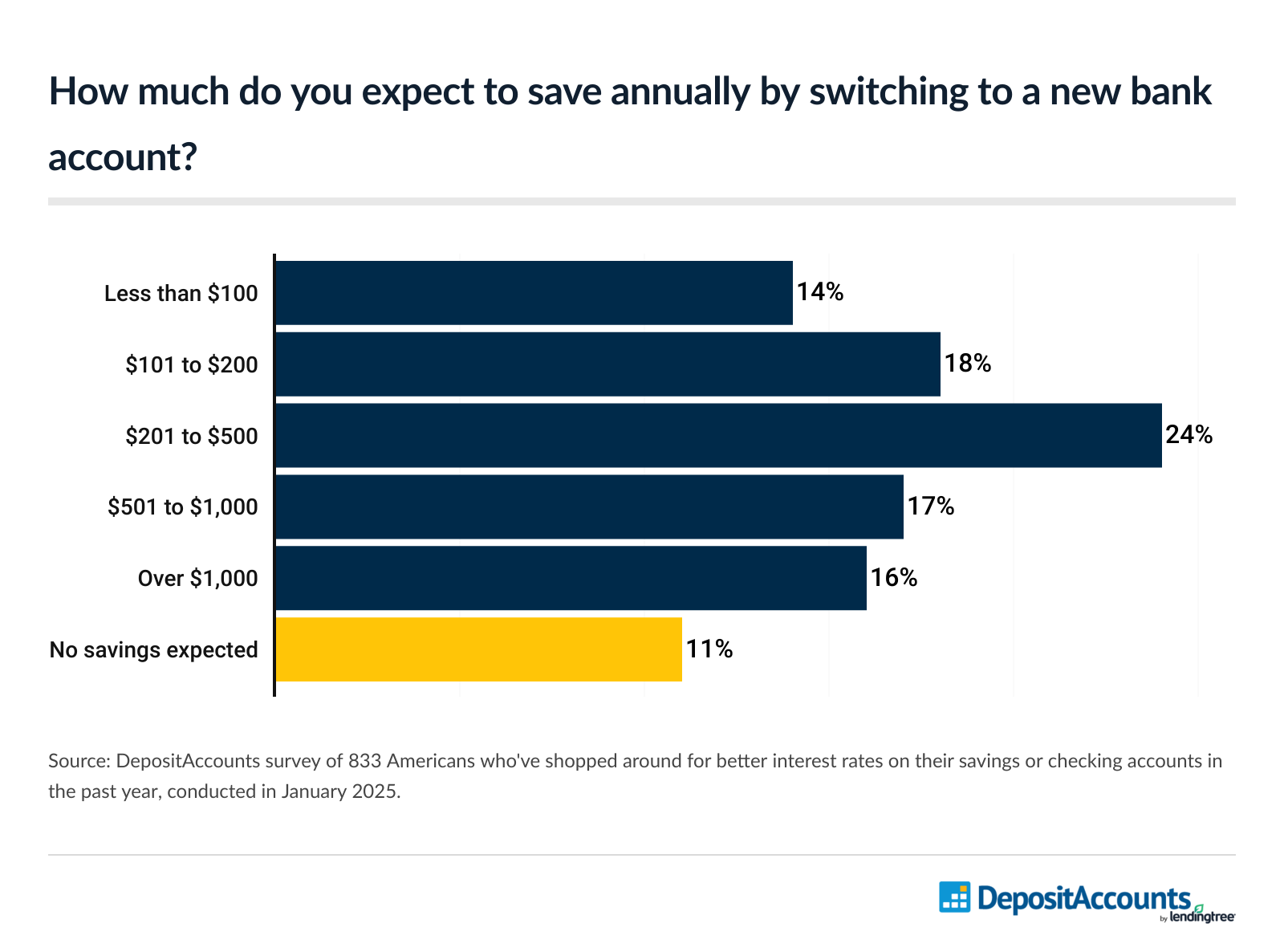

- Consumers have differing expectations about the financial benefits of switching accounts. 56% who’ve shopped around in the past year expect to save $500 or less annually, 16% expect to save more than $1,000 and 11% don't expect any savings. The most optimistic groups about annual savings are high earners, with 33% expecting to save over $1,000.

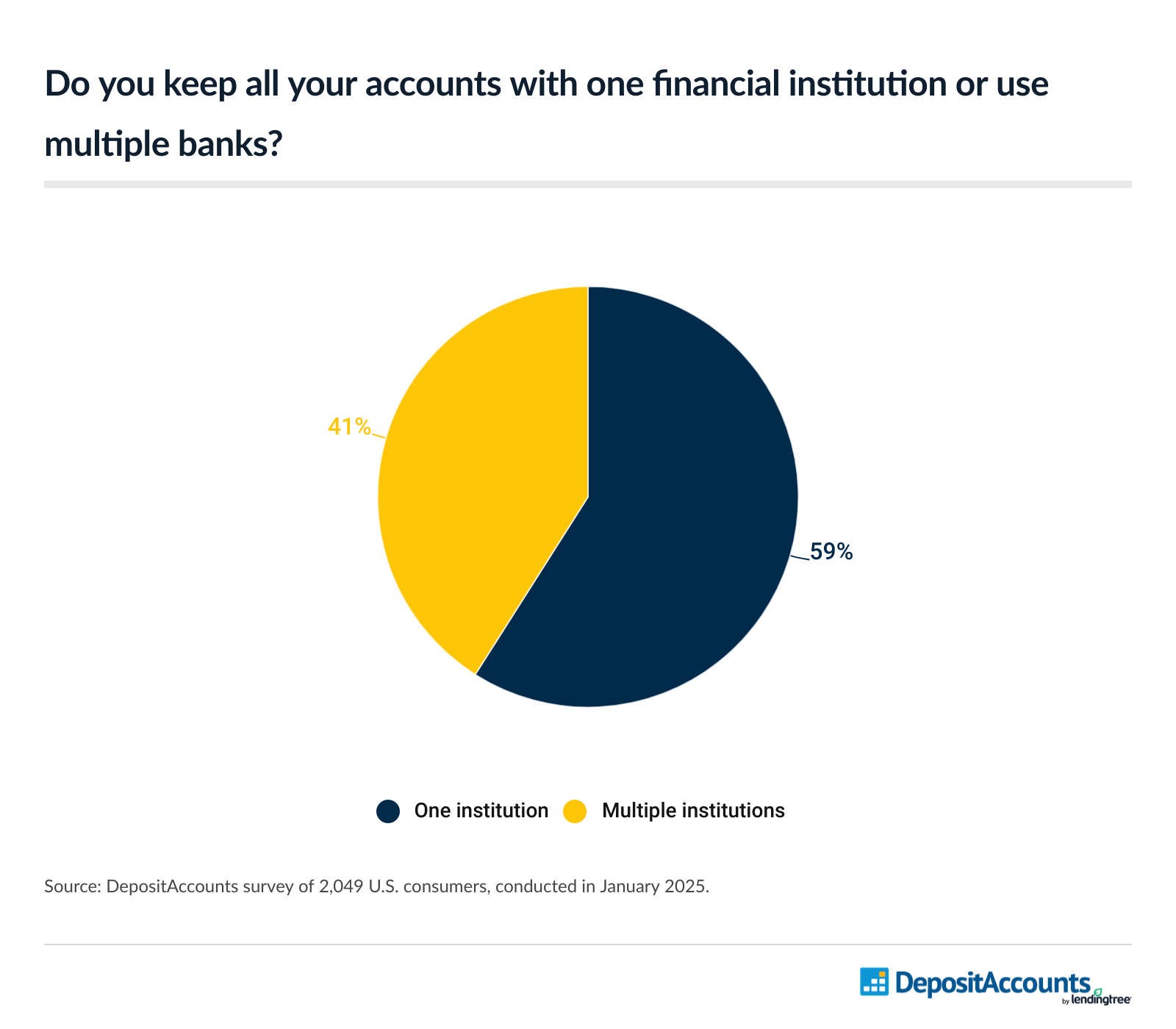

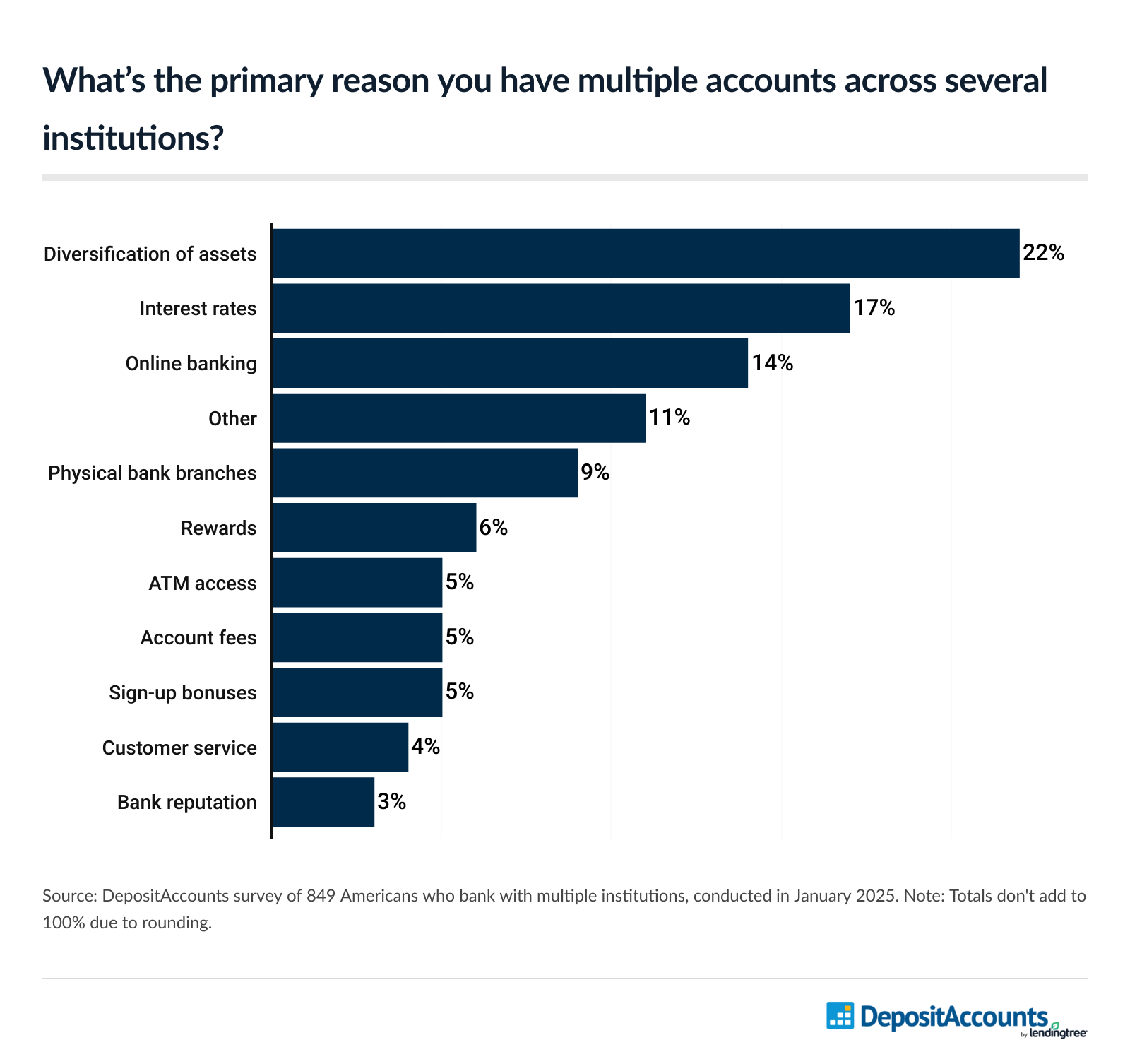

- 59% of Americans use a single bank for all their accounts. Among those who use multiple financial institutions, the three most common reasons are asset diversification (22%), interest rates (17%) and online banking (14%). For millennials (21%) and Gen Zers (19%), online banking is the top priority when choosing multiple institutions, while baby boomers (28%) and Gen Xers (25%) focus more on asset diversification.

Shopping around for best APY could offer significant boost

A good APY can make a difference. Looking at checking accounts, shopping around for the best APY can save 4.3% in a year and 51.9% in 10 years.

At the time of our analysis (Jan. 16, 2025), we found APYs ranging from 0.01% to 4.20% on certain deposits. (Comparatively, the average APY for a checking account is 0.07%.) With balances of $1,000, that means an additional $43 in a year and $520 in 10 years. With balances of $25,000, those boosts grow to $1,067 in a year and $12,996 in 10 years.

| How shopping for highest APY on checking account could boost your balance in 1 year | ||||||||

| Balance | Lowest APY | FDIC avg. | Highest APY | Balance after 1 year with lowest APY | Balance after 1 year with FDIC avg. | Balance after 1 year with highest APY | $ difference, lowest and highest | % difference, lowest and highest |

| $1,000 | 0.01% | 0.07% | 4.20% | $1,000 | $1,001 | $1,043 | $43 | 4.3% |

| $5,000 | 0.01% | 0.07% | 4.20% | $5,001 | $5,004 | $5,214 | $213 | 4.3% |

| $10,000 | 0.01% | 0.07% | 4.20% | $10,001 | $10,007 | $10,428 | $427 | 4.3% |

| $25,000 | 0.01% | 0.07% | 4.20% | $25,003 | $25,018 | $26,070 | $1,067 | 4.3% |

| How shopping for highest APY on checking account could boost your balance in 10 years | ||||||||

| Balance | Lowest APY | FDIC avg. | Highest APY | Balance after 10 years with lowest APY | Balance after 10 years with FDIC avg. | Balance after 10 years with highest APY | $ difference, lowest and highest | % difference, lowest and highest |

| $1,000 | 0.01% | 0.07% | 4.20% | $1,001 | $1,007 | $1,521 | $520 | 51.9% |

| $5,000 | 0.01% | 0.07% | 4.20% | $5,005 | $5,035 | $7,604 | $2,599 | 51.9% |

| $10,000 | 0.01% | 0.07% | 4.20% | $10,010 | $10,070 | $15,208 | $5,198 | 51.9% |

| $25,000 | 0.01% | 0.07% | 4.20% | $25,025 | $25,176 | $38,021 | $12,996 | 51.9% |

| Source: DepositAccounts analysis of database and Federal Deposit Insurance Corp. (FDIC) data. Notes: This chart assumes one deposit at the beginning of the one or 10 years, with interest compounded monthly. Rates may change at any point. | ||||||||

Based on the median transaction account balance of $8,000, that means earning an additional $342 in one year and $4,159 in 10 years on your checking account. (Transaction accounts include checking accounts, savings accounts, money market accounts, call accounts and prepaid debit cards.)

Matt Schulz — LendingTree chief credit analyst and author of "Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life" — says those savings can be significant.

“Even if you're only talking about a few dollars a month, that’s money that can go toward your financial goals, such as building an emergency fund or saving for retirement,” he says. “Perhaps the best part is that it’s essentially free money. All you need to do is shop around for a high-yield account, open it, move your money in and watch it grow.”

Savings accounts offer even greater boosts than checking accounts

Generally speaking, savings accounts have better APYs, at an average of 0.42%. Our analysis found APYs ranging from 0.01% to 4.75%, with 31 high-yield savings accounts with APYs exceeding 4.00%.

By comparing rates and selecting the best APY, consumers could see their balance grow by as much as 4.9% in a year and 60.5% over a decade. For balances of $1,000, that means an extra $49 in a year and $606 in a decade.

| How shopping for highest APY on savings account could boost your balance in 1 year | ||||||||

| Balance | Lowest APY | FDIC avg. | Highest APY | Balance after 1 year with lowest APY | Balance after 1 year with FDIC avg. | Balance after 1 year with highest APY | $ difference, lowest and highest | % difference, lowest and highest |

| $1,000 | 0.01% | 0.42% | 4.75% | $1,000 | $1,004 | $1,049 | $49 | 4.9% |

| $5,000 | 0.01% | 0.42% | 4.75% | $5,001 | $5,021 | $5,243 | $242 | 4.8% |

| $10,000 | 0.01% | 0.42% | 4.75% | $10,001 | $10,042 | $10,485 | $484 | 4.8% |

| $25,000 | 0.01% | 0.42% | 4.75% | $25,003 | $25,105 | $26,214 | $1,211 | 4.8% |

| How shopping for highest APY on savings account could boost your balance in 10 years | ||||||||

| Balance | Lowest APY | FDIC avg. | Highest APY | Balance after 10 years with lowest APY | Balance after 10 years with FDIC avg. | Balance after 10 years with highest APY | $ difference, lowest and highest | % difference, lowest and highest |

| $1,000 | 0.01% | 0.42% | 4.75% | $1,001 | $1,043 | $1,607 | $606 | 60.5% |

| $5,000 | 0.01% | 0.42% | 4.75% | $5,005 | $5,214 | $8,033 | $3,028 | 60.5% |

| $10,000 | 0.01% | 0.42% | 4.75% | $10,010 | $10,429 | $16,065 | $6,055 | 60.5% |

| $25,000 | 0.01% | 0.42% | 4.75% | $25,025 | $26,072 | $40,163 | $15,138 | 60.5% |

| Source: DepositAccounts analysis of database and FDIC data. Notes: This chart assumes one deposit at the beginning of the one or 10 years, with interest compounded monthly. Rates may change at any point. | ||||||||

With balances of $25,000, that translates to $1,211 in one year and a whopping $15,138 over 10. And for the median $8,000 balance, that translates to earnings of $387 over a year and $4,844 over 10 years.

While high-yield savings accounts are great, Schulz cautions they're not perfect.

“Withdrawals likely aren't instant, and there could be limitations on how many of them you can make in a month,” he says. “Rates can fluctuate and likely will when the Fed raises or lowers interest rates. There may also be minimum balance requirements to open an account. In most cases, none of these things should deter you from taking advantage of these high-yield accounts, but it’s important to know what you're getting into before opening one.”

About 2 in 5 Americans search for better interest rates

Despite the potential earnings, only about 2 in 5 (41%) Americans have searched for better interest rates on checking or savings accounts in the past year. That’s down from 43% in October 2022.

Tech-savvy Gen Zers ages 18 to 28 are the most likely to shop around for interest rates, at 60%. Comparatively, just 23% of baby boomers ages 61 to 79 say the same. Meanwhile, men (50%) are significantly more likely to shop around than women (32%). Those with children younger than 18 (52%), millennials ages 29 to 44 (51%) and six-figure earners (50%) are the only other demographics with at least half.

Among those who haven’t switched banks in the past year, 47% say it’s been over five years since they last did. Another quarter (25%) have never switched banks.

When it comes to choosing a new bank account, interest rates aren’t the most important factor for consumers. When asked, 79% of consumers said account fees were important. Meanwhile, 75% said online banking was important and 72% said interest rates were important. That’s followed by:

- Bank reputation (71%)

- Customer service (67%)

- ATM access (62%)

- Physical bank branches (58%)

- Rewards (42%)

- Sign-up bonuses (34%)

Most expect minuscule savings from switching accounts

Financially, consumers don’t expect significant savings when switching accounts. Among those who’ve shopped around for a new bank account in the past year, 56% expect to save $500 or less annually. Meanwhile, 16% expect to save more than $1,000 and 11% don't expect any savings.

Perhaps because they expect to deposit more money, high earners are generally more optimistic about their potential savings. In fact, 33% expect to save over $1,000. Millennials and parents with kids younger than 18 are also optimistic, with 22% holding the same expectation.

Men expect to save more than women by switching bank accounts, with 19% of men expecting savings of over $1,000. That compares with 12% of women.

The generally low expectations among most Americans may be due to ignorance. In fact, 67% don’t know the current APY for some or all of their savings or checking accounts.

Majority of Americans stick to one bank

Just under 3 in 5 (59%) Americans use one bank for all their accounts. For those who use multiple banks, 22% say they do so for asset diversification — the most common response. Interest rates (17%) and online banking (14%) follow.

By age group, millennials (21%) and Gen Zers (19%) prioritize online banking when choosing multiple institutions. Conversely, baby boomers (28%) and Gen Xers ages 45 to 60 (25%) are more likely to focus on asset diversification. Six-figure earners (28%) are also likely to focus on asset diversification.

While using one bank for all your accounts can be convenient, Schulz says there are some potential downsides.

“For example, if a bank has a tech issue that leads to accounts being either compromised or generally unavailable and all your money is in accounts in that bank, it could be a problem,” he says. “On the other hand, having accounts with other banks means you would still have ways to access funds while the bank fixes the problem. Also, if you’re late with a loan payment and have a checking or savings account with the same institution, they can pull funds from one of those accounts and apply it to the delinquent balance. That's called the right of offset.”

Lastly, the FDIC insures deposits up to $250,000 per depositor, per institution, per ownership category. This isn't a problem for most Americans, but having bank accounts with multiple lenders can allow you to have more funds under FDIC protection.

Choosing new bank: Top expert tips

Whether you’re looking for a better APY or simply want a new bank, Schulz says there are a few things to keep in mind. Particularly, he recommends the following:

- Don't be afraid of online-only accounts. “They may feel riskier than using a megabank, but as long as the online bank is FDIC-insured, your money is safe,” he says. “Of course, you should do your due diligence with them, including reading online reviews of their products and services. If that checks out, go ahead and take that step.”

- Look past the headline number. “Shopping for a high-yield savings account is a lot like shopping for a rewards credit card in that it can be easy to focus too heavily on one number and ignore other details,” he says. “With a card, it may be the sign-up bonus, but it’s the APY with a high-yield savings account. Both of those things are certainly important, but other details matter, too. Make sure you understand details like minimum balance requirements and fees before applying.”

- Think about long-term fit. A bank that works for you now might not be the best fit later. Consider potential changes to your financial needs, such as mortgage or investment options. Choosing a bank with a broad range of services can save you the hassle of switching later.

Methodology

Researchers analyzed the DepositAccounts database of 112 standard checking accounts and 182 high-yield savings account offerings. We found the lowest and highest APYs for both account types as of Jan. 16, 2025. (APYs may change at any point.)

We looked at four balance amounts — $1,000, $5,000, $10,000 and $25,000 — and assumed one deposit at the beginning of one and 10 years, compounded monthly with no additional contributions.

To determine the value of shopping for the best APY, researchers calculated the balance after one year and 10 years based on the four balance amounts and the lowest and highest APYs. Researchers then calculated the difference by dollar amount and percentage.

Additionally, DepositAccounts commissioned QuestionPro to conduct an online survey of 2,049 U.S. consumers ages 18 to 79 from Jan. 17 to 21, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79

What Is Bank Fraud? How to Recognize It, Avoid It and Report It

What Is Bank Fraud? How to Recognize It, Avoid It and Report It How to Open a Bank Account for a Minor

How to Open a Bank Account for a Minor How to Balance a Checkbook

How to Balance a Checkbook Retirement Savings: How Much Should I Save Each Month?

Retirement Savings: How Much Should I Save Each Month?