Value of Short-Term Certificates of Deposit?

One thing that has surprised me over the years is the popularity of short-term CDs. Several of my friends and colleagues would never consider CDs with maturities over one year. The 6-month term was often the most popular. It appears my friends weren't unusual. I reviewed call report data from the NCUA for two large credit unions, and the data shows more deposits in short-term CDs than long-term CDs.

You can review call report data from all the credit unions at the NCUA Find a Credit Union tool. This data includes the amount of deposits held in share certificates (CD) with maturities under 1 year, from 1 to 3 years and over 3 years. I reviewed the deposit data of two large credit unions: Navy Federal Credit Union and Pentagon Federal Credit Union (PenFed).

Both Navy Fed and PenFed have a long history of offering very competitive long-term CD rates. Their short-term CD rates have been fair, but rarely have they been near the rate leaders. So one would expect that most money would be in the long-term CDs. This is not the case.

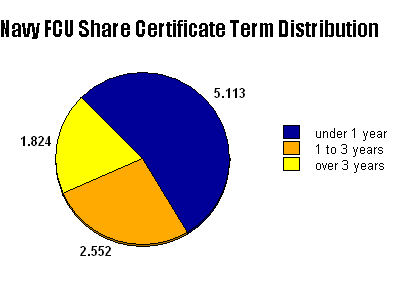

For Navy Fed, $5.1 billion (54 percent) of the CD deposits were in terms under one year, $2.6 billion (27 percent) were in terms from 1 to 3 years, and only $1.8 billion (19 percent) were in terms over 3 years. I've graphed these numbers in the following pie chart.

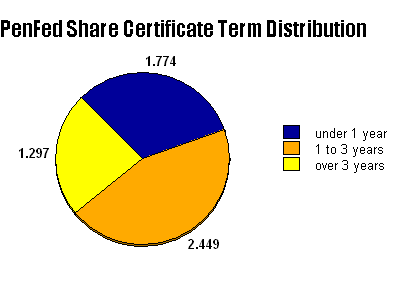

Not only does PenFed have a history of very competitive long-term CDs, it has also made it easy for anyone to join. So it would be reasonable to expect that long-term CDs would be the most popular. However, mid-term CDs (terms from 1 to 3 years) actually hold the most money with $2.4 billion in deposits (44 percent). Short-term CDs with terms under one year hold $1.8 billion (32 percent). Long-term CDs hold the least amount of money with $1.3 billion in deposits (23 percent). The pie graph below shows the distribution:

Short-Term CDs vs Savings Accounts

It's surprising to see the popularity of short-term CDs. In my opinion, it makes more sense to keep your money in savings or money market accounts instead of short-term CDs with terms under one year. You might earn a little more in interest with short-term CDs than in a savings account, but the slightly higher interest rate doesn't make up for the reduced liquidity.

As an example of how little benefit 6-month CDs provide over savings accounts, I reviewed the savings account and 6-month CD rates at Ally Bank over the last year. A year ago, Ally Savings Account yield was 1.09% and Ally's 6-month CD yield was 1.04%. Six months later Ally Savings Account yield had fallen to 1.04% and new 6-month CD yields had fallen to 0.99%. Today, the savings account yield is 0.84%. I estimated that the average yield over the last year for Ally Savings account is about 1.00%. The average for two 6-month CDs is 1.02%. The 6-month CDs may provide a little higher average rate than the savings account, but I wouldn't consider this high enough to make up for the reduced liquidity.

The liquidity feature of savings accounts may not be too important if you don't need the money for a while. However, it can be important if you want to take advantage of a good CD deal that pops up. The CD deal may end before your 6-month CD matures, and if you break the CD early, you'll be hit with an early withdrawal penalty. In addition, it can take a while to close the CD and move the funds into a liquid account. Even with an internet bank where you also hold a liquid account, it can take take some time. For example, when I closed Ally Bank's no-penalty CD, it took two business days before the money was transferred to my Ally savings account.

Short-Term CDs vs Long-Term CDs

If you want to maximize interest rates on the money that you want to keep safe, short-term CDs don't provide much value. Savings accounts are better choices especially at internet banks. To maximize interest rates, long-term CDs make more sense than short-term CDs. If you're concerned about having too much money locked into long-term CDs, using CD ladders and choosing CDs with mild early withdrawal penalties can help.

What Is Bank Fraud? How to Recognize It, Avoid It and Report It

What Is Bank Fraud? How to Recognize It, Avoid It and Report It How to Open a Bank Account for a Minor

How to Open a Bank Account for a Minor How to Balance a Checkbook

How to Balance a Checkbook Retirement Savings: How Much Should I Save Each Month?

Retirement Savings: How Much Should I Save Each Month?