Deposit Account Rate Trends of 2012

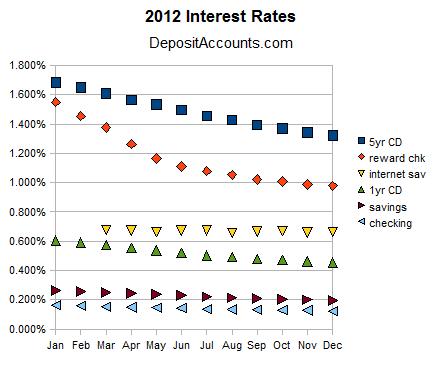

Over the last year I've been tracking the average deposit account rates. As you might have expected, rates have declined. However, not all have gone down by the same amount. Comparing the rate changes between the different account types are interesting, and this information may be useful if you're trying to decide on the type of deposit accounts for your savings in 2013.

Below is a graph showing how the average annual percentage yields (APY) of six deposit accounts have changed in 2012. The accounts include a 5-year CD, a 1-year CD, a regular savings account, a regular checking account, an internet savings account and a reward checking account. The average APYs include accounts from both banks and credit unions. The one exception is the internet savings account. This only includes internet banks. Also, this includes both internet savings accounts and internet money market accounts.

Below is a summary of the average APY changes for all of the above accounts from January of 2012 to January of 2013. For each account I've listed the change in terms of basis points (bps). A basis point is equal to one hundredth of a percentage point.

For reward checking accounts, I have also listed the change in the average balance cap. This is the maximum balance that qualifies for the reward checking account's top rate.

Average 5-Year CD APYs

- 2012: 1.685%

- 2013: 1.300%

- Down by 38.5 bps

Average 1-Year CD APYs

- 2012: 0.604%

- 2013: 0.447%

- Down by 15.7 bps

Average Savings Account APYs

- 2012: 0.264%

- 2013: 0.192%

- Down by 7.2 bps

Average Checking Account APYs

- 2012: 0.163%

- 2013: 0.121%

- Down by 4.2 bps

Average Internet Savings/MMA APYs

- 2012: 0.676%

- 2013: 0.662%

- Down by 1.4 bps

Average APYs: Top 10 Internet Savings/MMA

- 2012: 0.98%

- 2013: 1.02%

- Up by 4.0 bps

Average Reward Checking APYs and Balance Caps

- 2012: 1.551%, Balance cap: $22,512

- 2013: 0.964%, Balance cap: $20,471

- APY down by 58.7 bps

- Balance cap down by $2,041

Internet Savings Accounts - Holding Up the Best

The rates of internet savings and money market accounts had the smallest decline. The average rate fell by less than two basis points. A lot of this decline was driven by a few banks that slashed their rates this year. HSBC Bank is one of these. Its online savings account rate plummeted this year from 0.80% to 0.30%.

The impact of a few internet banks that have slashed rates this year had me wondering about the averages if these banks were excluded. I decided to look at the averages of just the top 10 internet savings and money market accounts. This is a useful average for rate chasers who don't mind moving their money to new internet banks once or twice a year. As you can see above, this average has actually gone up in the last year by 4 basis points.

Reward Checking Changes - Advantage Over Internet Savings Accounts?

Out of all the deposit accounts, reward checking account rates had the largest decline. Its average rate is now under 1%. Reward checking balance caps have also fallen. On the plus side, the rate decline has slowed in the last half of 2012.

This shows that reward checking has become less useful for savers as an alternative to CDs and internet savings accounts. If you have an average reward checking account, the top rate is probably not much higher than the best internet savings account rates. Also, it's likely that the balance cap is no longer $25,000. You'll have to decide the minimum rate spread and the balance cap that makes the extra work to meet the monthly requirements worthwhile. If you're only getting an extra 50 basis points on a $15K balance, that's only an extra $6.25 per month.

Long-Term CD Rate Changes - Continue with CD Ladders?

From the graph you can see that long-term CD rates have gone down more than 1-year CD rates and savings account rates.

These rate averages make the case for savers to keep more of their savings in internet savings accounts. The 5-year CD rates have gone down the most. Consequently, current 5-year CD rates are not that much higher than savings account rates. For example, if you look at the best rates that are nationally available today, you will only get an extra percentage point with a 5-year CD over an internet savings account.

Over the last four years, the rate lock of 5-year CDs was nice as rates continued to fall. Many were locked into 6% CDs while savings account rates dropped from 5% to under 1%. That rate lock is less useful now with CD rates under 2% and savings account rates that are not falling as much.

If you have been using CD ladders with long-term CDs, I don't want to suggest that you should stop renewing those CDs on the ladder as they mature. If rates remain low for many years to come, CD ladders with long-term CDs will do better than keeping that money in savings accounts. However, the big drop in long-term CD rates over the last year has reduced the benefit of CD ladders. A mixture of CDs and savings accounts still make sense. As the spread between CD rates and savings account rates shrink, it's making more sense to allocate more into savings accounts.

Note About Our Rate Averages

One final note is that these averages are based on accounts from both banks and credit unions. This results in averages that are higher than the averages reported by others. For example, the FDIC uses averages gathered by RateWatch and uses these averages to determine rate caps for less than well capitalized banks. The FDIC's current averages for savings accounts, 1-year CDs and 5-year CDs are 0.07%, 0.23% and 0.84%.

What Is Bank Fraud? How to Recognize It, Avoid It and Report It

What Is Bank Fraud? How to Recognize It, Avoid It and Report It How to Open a Bank Account for a Minor

How to Open a Bank Account for a Minor How to Balance a Checkbook

How to Balance a Checkbook Retirement Savings: How Much Should I Save Each Month?

Retirement Savings: How Much Should I Save Each Month?