Review of the Honeyfi Budget App

For many couples, managing money together can be a big challenge. The Honeyfi app is designed to help you meet this relationship challenge, so that you and your significant other work together to get a handle on your finances, both individually and as a couple.

This app asks both partners in a relationship to set up their own profiles, then choose how much financial information they wish to share with each other. Once these parameters are set, the app works to provide couples a better picture of their common budget and expenses, all in one place. The app also helps couples save money for individual and shared goals.

The services aren’t free, so couples will have to decide whether the app’s capabilities are worth the cost. Read on below to get a better idea of if this app is the right fit for you and your significant other.

What is Honeyfi?

The app lets couples build a budget together, communicate about their shared finances, and save towards specific goals like buying a home or taking a trip together. In order to accomplish these goals, it offers the following features:

Budget tracking

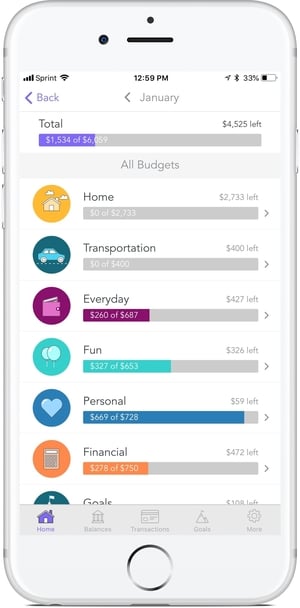

When setting up your profile in the app, one of the first steps is to link external checking, credit card, and investment accounts to the app. After linking your accounts, the app reviews your most recent transactions, classifies spending under specific categories, and creates a budget for you and your partner. You can edit the budget and the spending categories at any time.

Both partners in a relationship using the app may control how much information they wish to share with their partner. For each account you link to the app, you can choose to share balances, individual transactions, or both. There’s also the ability to set transaction notifications so that each partner can easily see where money is being spent.

The app lets you to take specific transactions and split them over multiple categories and view multiple transactions from different accounts at the same time. If you set savings goals (more on that below), they will be reflected in your budget as well.

Honeyfi savings account

Like many similar money management tools, this app offers a savings account feature that is built into the app. The savings account lets users set up individual and shared savings goals. Funds you put into the account are held with Honeyfi’s partner bank, The National Bank of Kansas City, and are FDIC insured up to the maximum of $250,000.

Your savings goals are included in the budget plan you build in the app, and funds may be automatically transferred into savings to meet the goals. You can set weekly or monthly recurring transfers, or choose “payday triggers” that transfer funds upon receipt of a paycheck.

One great feature of the account is that users are not limited to six account withdrawals per month, as with conventional savings accounts — savings withdrawals are unlimited.

The savings account earns 1.00% APY, which the company referred to as “savings bonus,” paid into the account every three months. This is not the worst yield available on the market, but it is far from being close to the best available savings account rates.

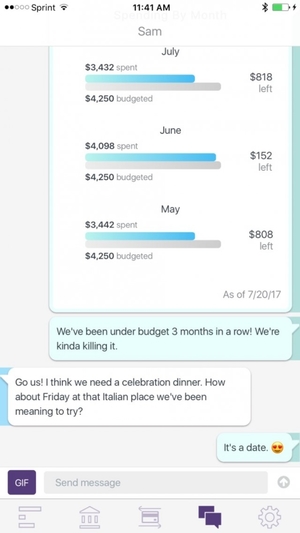

Built-in communication

HThis app allows couples to communicate about their finances in the app. Each member of the couple can add a comment or reaction to specific transactions, and each comment or reaction triggers a notification in real time. The app even lets couples send gifs to each other.

How to get started with Honeyfi

To get started, the first thing you’ll need to do is go to either the App Store for iOS devices or the Google Play Store for Android and find the app to download it. You can also get there by clicking the “Get the app” button on Honeyfi’s website, which will send you a link to the app.

From there, it’s a matter of creating an account by registering your name, a working email, and a password. If your partner hasn’t already signed up, you’ll be asked to input their name and email, too. They’ll be sent an “invite code”, which will help them link their account to use when they’re ready to join.

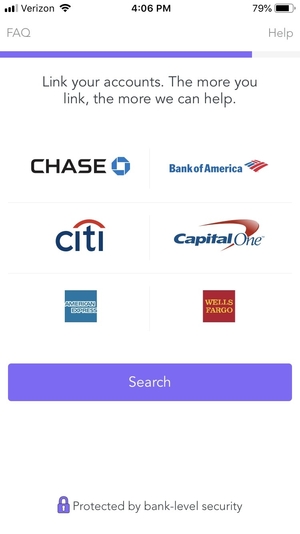

Link your external accounts

Once you have an account, select your bank or financial institution from a list of approved partners. Then you’ll be asked to agree to some terms of service and taken to a window where you can login to your bank account.

You’ll repeat this process for each account that you would like to connect to the app. In addition to bank accounts, the app also supports credit card accounts and investment accounts, giving you a fuller picture of your finances in one place.

How much does Honeyfi cost?

You can begin using the app with a 30-day free trial. After that, you can choose to pay either $7.99 per month or $59.99 per year to keep using the app. However, you only need to make one payment per couple.

While the app's co-founders purposely strive to create an ad-free experience, the app will sometimes recommend relevant services to its users. Users are asked to opt-in before their information is ever shared with any partnering brands.

The company makes some of its revenue by keeping a portion of the interest that the money in your savings account earns while it’s being held by Honeyfi’s partner bank, though it does not specify the exact amount or percentage.

Who should use Honeyfi?

At its core, Honeyfi is for couples who want a clearer picture of their finances and would like to save for specific goals. While the app does provide ways to keep certain financial information separate, it will likely work best for couples who are interested in complete financial transparency with each other.

Note that the sign-up process requires you to register two email addresses, hammering home the intended use case. If you don’t have someone with whom you’d like to share financials, you might be better served by one of the money alternative budgeting apps on the market.

Is Honeyfi safe to use?

Prospective users of the app may have safety concerns about linking so many of their financial accounts to the app. However, the company assures us that maintaining security around user data is a primary concern.

How? Honeyfi partners with a third-party aggregator known as Plaid, which has agreements in place with many of the major banks that Honeyfi connects to; in turn, their safety measures have been properly vetted by those financial institutions. Honeyfi confirms that no user credentials for third-party accounts — usernames, account numbers, or passwords — are stored with them.

In addition, the company notes that it has other security measures in place, such as periodically asking users to refresh their credentials, and they also offer the opportunity to sign into their accounts via fingerprint verification on user devices.

The pros and cons of Honeyfi

Pros

- Provides a combined picture of both partners’ finances

- Allows both partners to maintain separate profiles and control the amount of information they share with each other

- Users can link checking, credit card and investment accounts to the app

- Chat feature lets users communicate about specific transactions

- Users can create custom categories to track their spending

Cons

- Charges a monthly fee for use

- The app builds budgets based on past transactions, which may not be accurate for users with variable incomes

- While the savings account earns 1.0% APY, this is not a competitive savings rate when compared to the best online savings accounts available

- Users cannot establish custom budgeting sub-categories

How does Honeyfi stack up to the competition

Honeydue

Honeydue is another financial app aimed at couples. Like Honeyfi, it offers users the ability to share information about their account balances and individual expense transactions. Notably, it’s also currently free to use. However, unlike Honeyfi, it doesn’t allow couples to customize the level of financial transparency that they’d like to have with each other and, as yet, there is no comparable savings goal feature.

Zeta Couples Finance

At face value, Zeta is a free app for couples that is very comparable to Honeyfi. Originally a savings and transaction tracking app, Zeta recently added budgeting features. Unlike Honeyfi, Zeta does not allow couples to have their own profiles or to customize whether you share just balances or individual transactions with your significant other; it does, however, offer the ability to customize which accounts you share with your partner, designate bills, and specific transactions as an individual or shared expense. Like Honeyfi, Zeta also offers couples the ability to comment on specific transactions for easy communication.

Twine

Twine is another savings app for people in a relationship that encourages users to save toward both individual and common goals like saving for a home or going on vacation. Unlike Honeyfi, Twine includes an investing feature that lets couples put money into ETFs and grow their wealth in the markets. Like Honeyfi, Twine charges fees, although they are for managing your money in the investment portfolios. Twine does not offer comparable budgeting or expense tracking features.

What Is Bank Fraud? How to Recognize It, Avoid It and Report It

What Is Bank Fraud? How to Recognize It, Avoid It and Report It How to Open a Bank Account for a Minor

How to Open a Bank Account for a Minor How to Balance a Checkbook

How to Balance a Checkbook Retirement Savings: How Much Should I Save Each Month?

Retirement Savings: How Much Should I Save Each Month?