Insuring Bank Deposits Over $250,000 With Multiple Ownership Categories

Long-time readers of this blog are probably aware that there are many ways to have FDIC coverage of more than $250,000 at one bank. However, as I described in past posts, you have to be careful. If you or your bank makes any mistakes, your money above $250,000 may not be covered. If the bank fails, that uninsured money could be lost.

After the financial crisis of 2008, the standard maximum deposit insurance amount was increased from $100,000 to $250,000. This is now permanent and applies to both banks and credit unions.

Before the insurance limit was increased, there was another important change that became permanent. That effectively eliminated the concept of qualifying beneficiaries for revocable trust accounts - commonly called payable-on-death accounts or living trust accounts. This made it easier to extend your FDIC coverage over the standard amount. Here’s how the FDIC now defines eligible beneficiaries:

To qualify as an eligible beneficiary, the beneficiary must be a living person, a charity or a non-profit organization. If a charity or non-profit organization is named as beneficiary, it must qualify as such under Internal Revenue Service (IRS) regulations.

The most important thing to note is that the beneficiary must be living. As soon as the beneficiary dies, the added coverage ends. There’s no grace period. That’s one reason you may want to use charities as beneficiaries. As I described in my post Maximizing Your FDIC Coverage with Beneficiaries, it’s easy to allocate the amounts to your beneficiaries so you can decide how much goes to the charities.

If you’re trying to find out how to cover your savings, you can review the details in this FDIC Comprehensive Seminar on Deposit Insurance Coverage For Bankers. Unlike the guide for consumers, this guide for bankers includes more details and examples which can be useful to ensure you understand all of the rules. The guide is dated March 23, 2011 so it includes the recent changes that have occurred in the last few years including the new higher standard coverage of $250,000.

In addition to using beneficiaries to extend your coverage, you can also use multiple account ownership categories. Four common ones include:

- Single Accounts

- Joint Accounts

- Revocable Trust Accounts (includes PODs/ITFs)

- Certain Retirement Accounts (includes IRAs)

One easy method for one person to insure $500,000 with just one beneficiary is to open both a single account and a POD account. However, this requires two accounts. One account with one POD will only insure $250,000. To show this, I used the FDIC EDIE calculator. Below is a snapshot showing the uninsured amount for one CD with a single owner and one POD:

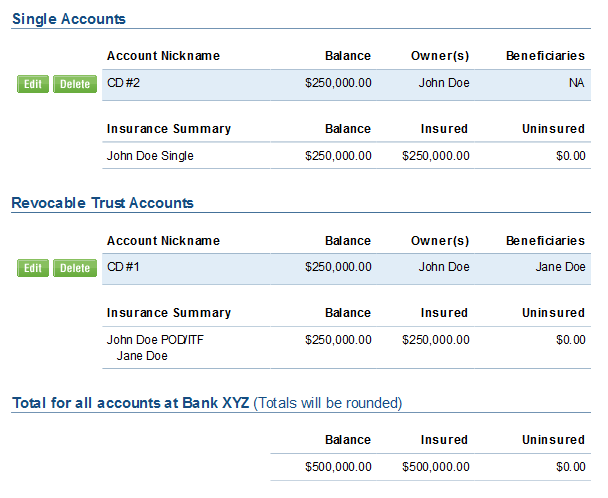

For one person with one beneficiary to insure $500,000 at one bank, the person needs to open two accounts: a single account without a beneficiary and a revocable trust account which can be just a POD account. The person can then have $250,000 in the single account and $250,000 in the revocable trust account and be fully insured. Below is a snapshot showing the entire amount is insured:

For a couple who opens single accounts, joint accounts and revocable trust accounts, it’s easy to insure $1.5 million at one bank. I’ll let you see how this can be done by using the FDIC EDIE tool. If you can find out a way to go above $1.5 million without any additional persons for beneficiaries, please leave a comment.

NCUA coverage for credit unions is essentially equivalent to FDIC coverage. In fact, I found the NCUA Share Insurance Calculator to be very similar to the FDIC EDIE tool. If you find any differences, please leave a comment.

What Is Bank Fraud? How to Recognize It, Avoid It and Report It

What Is Bank Fraud? How to Recognize It, Avoid It and Report It How to Open a Bank Account for a Minor

How to Open a Bank Account for a Minor How to Balance a Checkbook

How to Balance a Checkbook Retirement Savings: How Much Should I Save Each Month?

Retirement Savings: How Much Should I Save Each Month?