Odd-Term CDs Are All the Rage in This Rising Rate Environment

If you regularly shop for the best CD rates, you know this truth: that the best deals don’t always come in tidy conventional packages.

Follow the DepositAccounts blog with any frequency and you’ll see featured CDs with maturity terms of 150 days, 19 months, two and a half years – you name it. The same is true if you hunt for top rates in any of our CD rate tables. You’ll find abundant evidence that the FDIC and NCUA have imposed no requirements that CDs be issued in even, yearly terms.

With so many odd terms popping up among the best CD rates, we got curious about how common a practice this actually is among banks and credit unions that are boosting their rate sheets. Are odd-term CDs a preferred vehicle for specials and promotions, especially on the front end of a rising rate environment? Are some institution types more likely than others to practice it? We dug into our extensive database to find out.

Defining four CD pools

To kick things off, we set our control group by looking at how many CD products existed in total in our database on the day before the study period. We decided to look at CDs that ranged in length from a little less than a year to a little more than five years. Specifically, we targeted CDs with maturities of 10 months to 65 months. We also limited the search to only standard personal CDs (i.e., excluding relationship products and specialized CDs targeted to youth, seniors, etc.), and included only reasonably large institutions ($200 million or more in assets), excluding small institutions since their products aren’t broadly available.

On November 13, 2016, we had rates on record for over 38,000 such CDs from banks and credit unions across the country. Pulling this pre-study population of all CDs became our “baseline pool” and enabled us to see how common odd terms are among the overall mix of certificates in the marketplace. You can see the term distribution here.

Next, we set out to focus our analysis. We wanted to look at CD rates that were recently unveiled or improved. We chose four months as a sufficiently long period to capture a large population of CD increases, and we set the timeframe bookends to mid-November 2016 and mid-March 2017 in order to encompass the hottest recent period of rising CD rates.

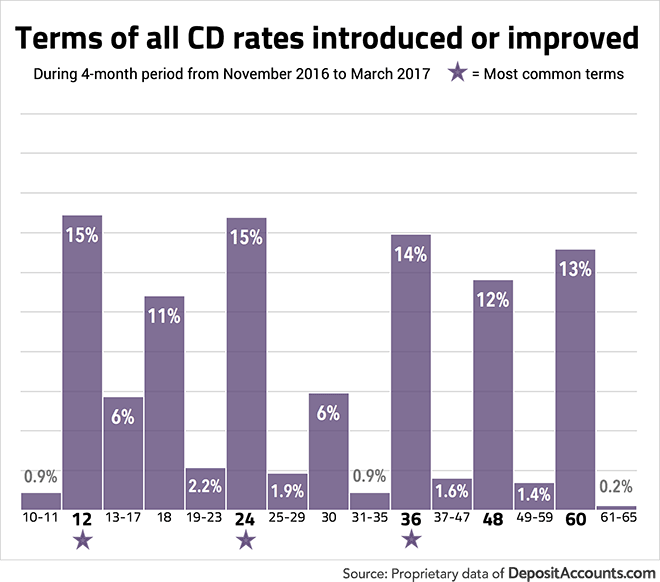

We then pulled all the CD rates in our database that matched our criteria and that represented either a newly introduced product (i.e., it had not existed directly before this period) or an increased rate during the period. Counting each unique CD product only once no matter how many increases were applied over the four months, we identified 4,086 CDs on which to assess the prevalence of odd versus even-yeared terms. This was our “new rates” pool, and is shown with its term distribution below.

Since the main part of our curiosity was whether odd terms are more common among institutions who are offering new or “hot” top-drawer products, we also needed to boil down the “new rates” pool above to a smaller “top rates” pool. We did this by segmenting the 4,000+ CDs into seven maturity buckets, which collectively straddled the 12-, 18-, 24-, 30-, 36-, 48- and 60-month marks. From each of these seven buckets, we skimmed off the top 25-30 best rates, resulting in a “Top 200” list of the highest-rate CDs that had been introduced or increased during our study period. Among these, we found the following frequency of terms.

Lastly, we know that our blog commentary presents a fairly comprehensive look at the most competitive CDs from institutions with reasonable market reach. In choosing which deals to feature, Ken has no bias toward length of term, or whether it’s odd or yearly. Instead, his criteria are that the deal is a notably competitive rate for a reasonably large population market. For example, deals offered by a small niche credit union serving 2,000 members don’t appear. But since institutions like that are inaccessible to most Americans, they aren’t consequential to the big picture.

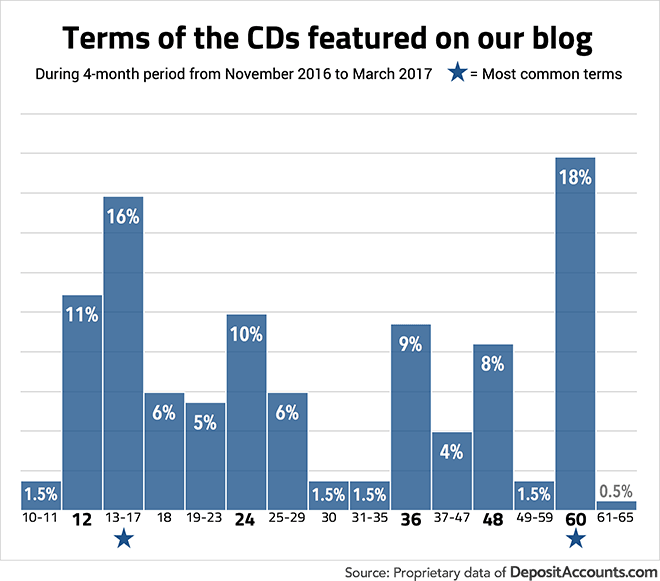

To populate this last comparison pool, I did a manual count of the CD terms featured on our blog over the same four-month study period, noting every highlighted CD with a maturity of 10 to 65 months. This became the “blog pool”, with just a smidge over 200 CDs, and is shown in term distribution below.

So how common are odd terms? Here’s what we found.

First, one more definition is in order. Although 18-month CDs are not uncommon on bank rate sheets, we opted for a strict “odd term” definition of any maturity that is not an even, yearly term. So anything other than pure 1-year, 2-year, 3-year, 4-year, and 5-year terms was deemed “odd”, including 18- and 30-month CDs.

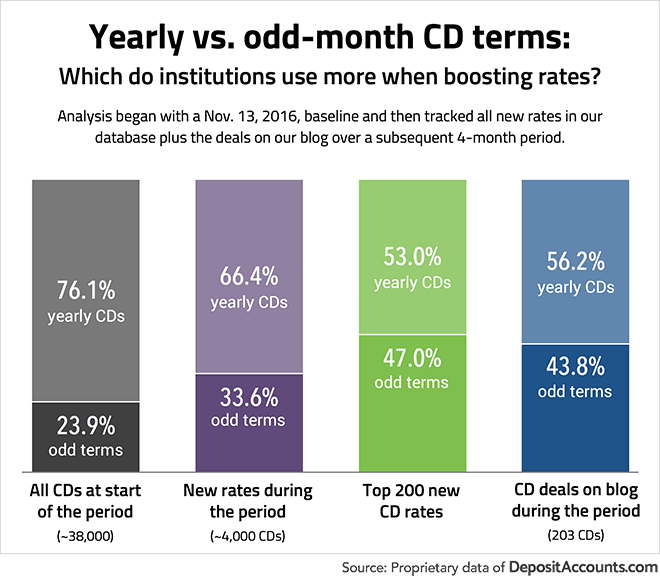

Starting with the baseline pool of all 38,000+ tracked CDs before the study period, we found that only about a quarter (23.9 percent) were odd terms.

But things shifted a bit as we looked at all the new-rate CDs during the four-month period. Of the 4,000+ new and improved-rate CDs here, over 1,400 were odd terms. This represents one out of every three CDs, up to 33.6 percent in this group.

Then came the crème de la crème pools. If our hypothesis is right that odd terms are a common strategy among institutions aiming to attract consumers with great rates, then odd terms should represent a larger share of the Top 200 and blog pools.

And indeed that was borne out. The highest rate of odd term CDs occurring within any pool was among the Top 200 CD rates, where almost half (47 percent) were odd terms. Similarly, almost 44 percent of the blogged CD deals had odd terms.

Do banks and credit unions behave differently here?

As we often do here, we looked also at how the data compared and contrasted across different institution types. Does one type offer odd terms more often than others?

The short answer is that physical banks are the most inclined to offer odd-term CDs, while internet banks are the least likely. As you can see in the chart below, credit unions offer odd terms at close to the same rate as physical banks, but not quite.

Of all the physical banks that offered new or improved rates during the study period, more than three quarters (76 percent) of those banks included at least one odd-term CD in their mix of new rates. For credit unions, the share was just under 70 percent.

In terms of individual new rates, 36 percent of those offered by physical banks were odd terms, versus 3 in 10 for credit unions.

And in a third slicing of the data, credit unions fell just behind physical banks. Of the Top 200 new rates during the period, a little more than half of those from physical banks were odd-term CDs, and just under half was the case for credit unions.

The chart above shows that online banks were the least likely to offer an odd term CD, and especially so within the Top 200 rates. While the variance from physical banks and credit unions is significant enough that I don’t doubt the general finding, it must be noted that the sample size of online banks is entirely dwarfed by the number of physical banks and credit unions. There are simply far fewer internet banks than brick-and-mortar institutions.

Specifically, of the more than 1,000 institutions who raised or improved a rate during the study period, only 22, or 2.2 percent, were internet banks. Similarly, the number of new rates from an online bank was only 77 out of more than 4,000 new rates, for 1.9 percent. So while the data suggest online banks lean more on conventional yearly terms than their physical counterparts, the margin of error is much greater here given the small available sample.

Final words

So what are the takeaways? For one, people who like to keep a CD portfolio in neat, yearly-termed ladders are not out of luck. More than half of even the very best rates carry conventional maturity periods, so there is no shortage.

But it’s also true that, when searching for the top earners, flexibility to choose an odd term will regularly afford savers an excellent deal. With almost half of the top rates being odd terms, that means almost every other competitive rate that a shopper encounters will be something different than a standard year term.

Why do banks and credit unions put these odd terms in the marketplace? There are a few different reasons an institution might find the strategy worthwhile. For one, odd-term CDs are very often set to renew to standard terms, such as a maturing 27-month CD auto-renewing to the more standard 2-year rate. For customers who aren’t careful and let their CDs automatically rollover, this means they’ll very likely find their funds locked into a standard term certificate, which may be paying a much lower rate.

Offering odd terms also helps a bank or credit union delineate their specials and promotions from their standardized menu of CDs. Not only might this help their product tracking by making specials easy to identify, but it also helps alleviate the problem that can occur when a bank suddenly offers, say, a special 12-month rate to new customers that is much better than the prior 12-month rate that all existing customers are locked into. It helps the institution make these products look a little different than existing products so that customers aren’t able to make a perfect apples-to-apples comparison.

This might also help explain why we found the practice of offering odd-term CDs to occur much more frequently in shorter maturities. Behind the most frequent odd terms of 18 and 30 months (which are common because they’re midpoints between two popular yearly terms), the next most offered non-standard maturities were in the 13-17 month range in three of the four pools. Only in the Top 200 rates pool was another odd-term bundle more frequent: 20-29. But in this Top 200 grouping, it’s easy to see a strong concentration across all terms from 12 to 30 months.

If a bank is offering an odd-term CD to get customers "in the door" and hopes to roll them into more standard rates in the future, the shorter the duration of that special period the better for the bank.

In the end, this analysis lends a data-driven corroboration to why it might seem like Ken’s blog includes a lot of 15- and 27-month CDs, and other odd terms. No, it’s not your imagination. As we’ve discovered, the data indeed show that rising-rate banks and credit unions take the odd-term tack a lot.

What Is Bank Fraud? How to Recognize It, Avoid It and Report It

What Is Bank Fraud? How to Recognize It, Avoid It and Report It How to Open a Bank Account for a Minor

How to Open a Bank Account for a Minor How to Balance a Checkbook

How to Balance a Checkbook Retirement Savings: How Much Should I Save Each Month?

Retirement Savings: How Much Should I Save Each Month?