PayPal Prepaid MasterCard Review

As prepaid debit cards go, the PayPal Prepaid MasterCard is an acceptable option, but it holds little attraction if you don’t have a PayPal account (or aren’t willing to sign up for one). Unless you have a PayPal account you can link to the prepaid card, you can’t access the full range of benefits associated with the program.

If you do have a PayPal account, you can enjoy the convenience of free money transfers to the card from PayPal, as well as the fact that some fees are lower than with other prepaid debit cards. Note, however, that there is no way to avoid either the monthly maintenance fee of $4.95, or the $1.95 ATM withdrawal fee. Among its other virtues are no-fee direct deposits, free mobile check deposits and a linked savings account that can earn you an attractive 5.00% APY on your first $1,000 in savings (but only 0.50% APY on amounts above $1,000).

PayPal Prepaid MasterCard features

The PayPal Prepaid MasterCard works best when you have a PayPal Personal or Premier account. While you can request a card without having a PayPal account, you miss out on the full range of benefits, including online account management tools. You’ll want access to these — particularly the options to review transactions, pay bills and check your balance.

Without a PayPal account, you’ll miss out on features or have to pay for them. For instance, checking your balance online is free, but it costs $0.50 at an ATM. That may not seem like a lot, but if you check your balance often, those charges add up. Loading funds is also cheapest and most convenient through your PayPal account, as you can add money to the card instantly and at no cost.

- Direct deposit: There is no fee for direct deposits on the card. Paychecks, government benefits and tax returns may be directly deposited. Depending when your employer or the government office issuing payment initiates the transaction, you may receive your money when the direct deposit is initiated, rather than when it clears, potentially getting access to your money up to two days ahead.

- FDIC-insured: Your PayPal Prepaid Mastercard funds will be held by the Bancorp Bank, which is insured by the Federal Deposit Insurance Corporation (FDIC). Up to $250,000 is covered if Bancorp Bank fails (although the terms of the PayPal Prepaid Mastercard limits you to having no more than $15,000 deposited on the card).

- No credit check: You won’t be subjected to a credit check. However, you will need to provide your name, street address, Social Security Number and other personal details to verify your identification and activate the card.

- Savings Account: As a PayPal Prepaid MasterCard account holder, you have the option of opening a savings account with Bancorp Bank. The account is tiered, with different interest accrual rates depending how much you have in the account. If you keep $1,000 or less in the account on a daily basis, you’ll earn 5.00% interest. Keep more than $1,000 a day in there and you’ll still earn 5.00% interest on everything under $1,000, but just 0.50% on any amount above that.

- Cashback rewards: Cardholders are eligible for certain cashback reward offers when shopping with their PayPal Prepaid MasterCards. You can learn more about these promotions and their terms in your online account portal.

- Referral bonuses: Refer your friends to the PayPal Prepaid MasterCard and you’ll earn $20 when they activate their cards and load $40 onto their accounts. They’ll also receive a $20 bonus. There’s no limit to the number of friends you can refer.

- No-cost assistance in finding reload locations: If you want to add money to your card at a Netspend Reload Network location, you can text your ZIP code to a designated number and receive a message listing those closest to you. PayPal will not charge for this service, though your carrier may. You can also search for Netspend locations for free online through the Reload Center Locator.

PayPal Prepaid MasterCard fees and fine print

Several fees are associated with the PayPal Prepaid MasterCard, including a purchase fee if you sign up through a retailer and a monthly fee of $4.95. However, you can be strategic about how you add and withdraw money from your account to avoid paying for these services every time you need to access your funds.

For example, when you load money onto the card at a retail location, you’ll have to add a minimum of $10 or $20, depending on that store’s stipulations. To avoid those minimums, add money via your PayPal account, mobile check deposit or direct deposit.

In addition to the fees listed below, the PayPal Prepaid Mastercard also carries deposit limits. Reloads at retail locations are capped at $500, and your total balance across all Bancorp Bank cards cannot exceed $15,000.

|

|

|

|---|---|

| Card purchase fee | Varies by retailer |

| Minimum initial load | $10-$20, depending where you purchase |

| Additional card fee | $0 |

| Card delivery fees | $0 for delivery within 7-10 business days $20 for delivery in 3 business days $25 for delivery in 1-2 business days |

| Reload fee | $0 for direct deposit and standard mobile check load Up to $3.95 at Netspend Reload network locations |

| Add funds from PayPal account | $0 |

| Check deposit fee | $5 or 2% of the check amount, whichever is greater, for expedited mobile check load on government-issued checks $5 or 5% of the check amount, for expedited mobile check load on all other checks |

| ATM fees | $1.95 for domestic and international withdrawals |

| Card replacement fee | $5.95 |

| Monthly fee | $4.95 |

| Balance inquiry fees | $0 online $0 when calling Customer Service $0 using email and text alerts (though your carrier may charge for texts or data usage) $0.50 at domestic and international ATMs |

| Over-the-counter withdrawal fees | $2.50 at financial institutions, plus any additional fees the institution charges $4 or up to 2.75% of the withdrawal amount, whichever is greater, at Netspend Reload Network Locations |

| Foreign transaction fee | 2.5% of the transaction total |

| Stop payment fee | $10 |

| ATM transaction declined fees | $1 for domestic and international ATM withdrawals plus any machine operator fees |

| Automated Clearing House (ACH) transaction fee | $0 |

| Inactive account fee | $0 |

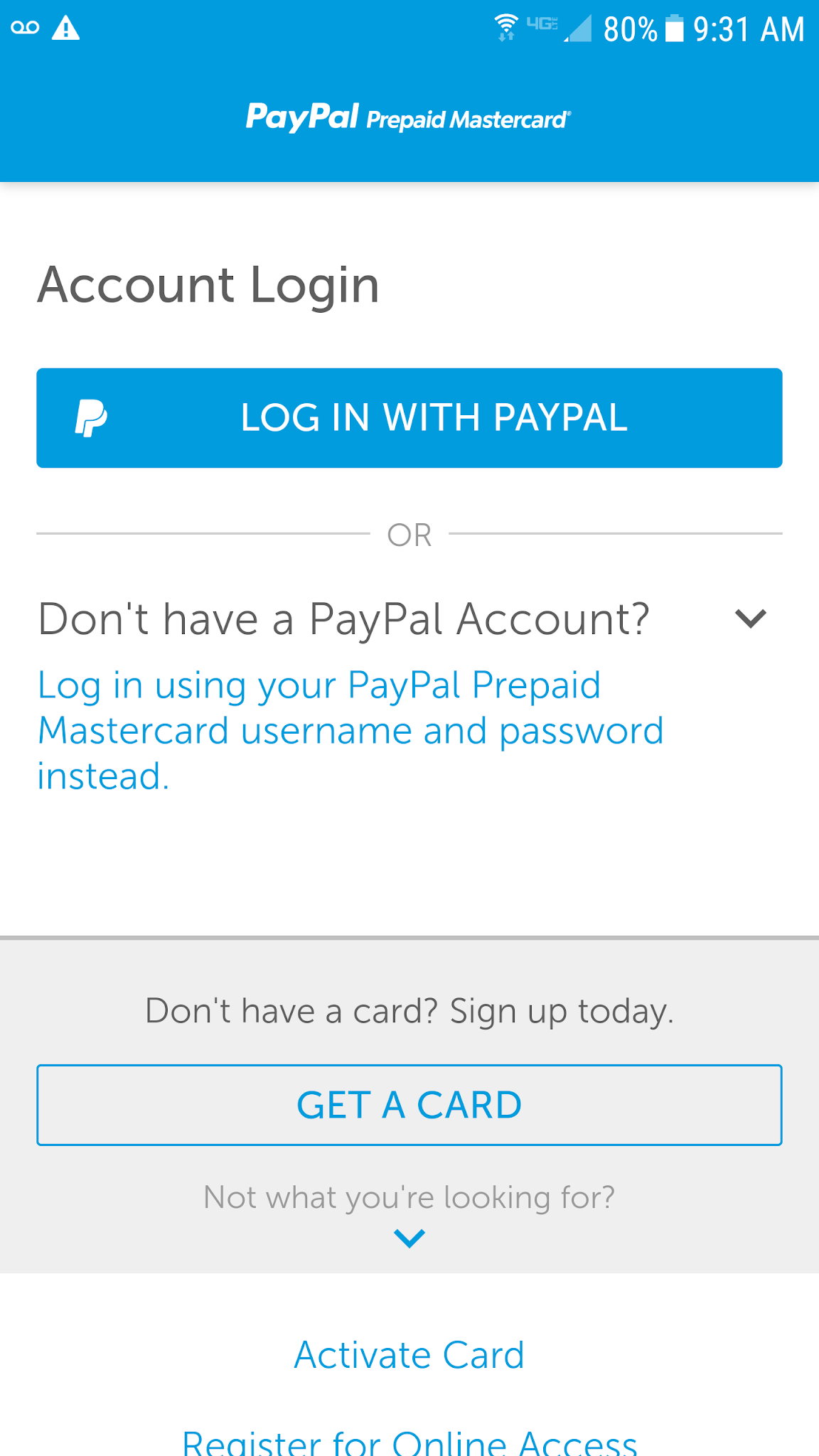

Using the PayPal Prepaid MasterCard mobile app

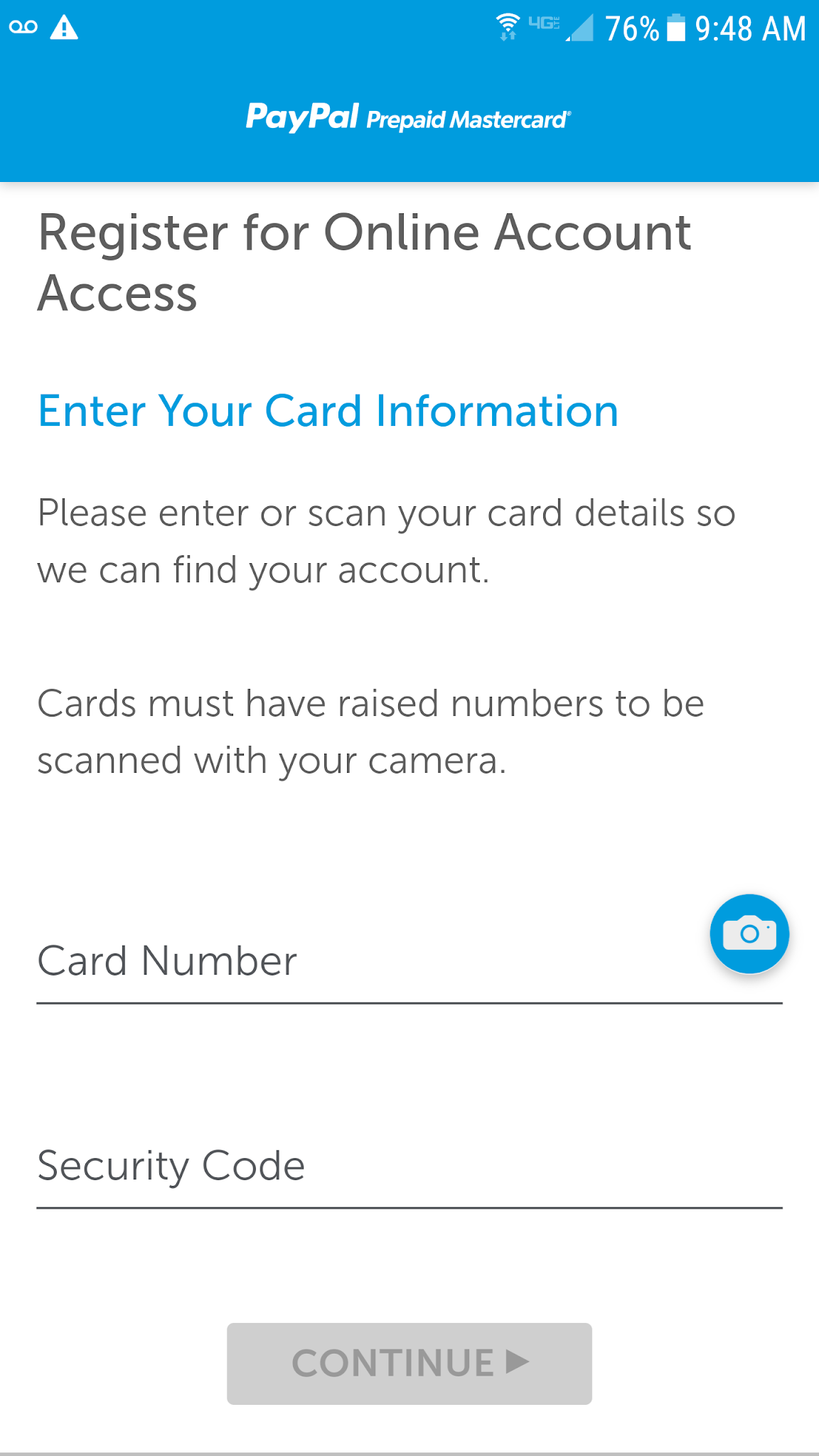

The PayPal Prepaid MasterCard mobile app is available through the Google Play store and the Apple App store. Once you’ve downloaded the app, you can log in using your PayPal Prepaid account or your regular PayPal account, provided you linked the two when activating your card online. If you have a PayPal account but haven’t yet received your prepaid card and set up the associated PayPal prepaid account, you won’t be able to use the app.

If you haven’t yet registered your card, you can do so through the app as well, either by manually entering the card information or scanning it with your smartphone camera.

Once you’re logged in, you can use the app’s mobile check deposit features, as well as review transactions and initiate money transfers from your PayPal account. You can also find nearby reload retailers if you’d rather add funds manually.

Opening a PayPal Prepaid MasterCard account

All U.S. residents who are ages 18 and older are eligible for a PayPal Prepaid MasterCard account, with the exception of those living in Vermont. Residents of U.S. territories, including Puerto Rico, American Samoa, the U.S. Virgin Islands and Guam, are also ineligible.

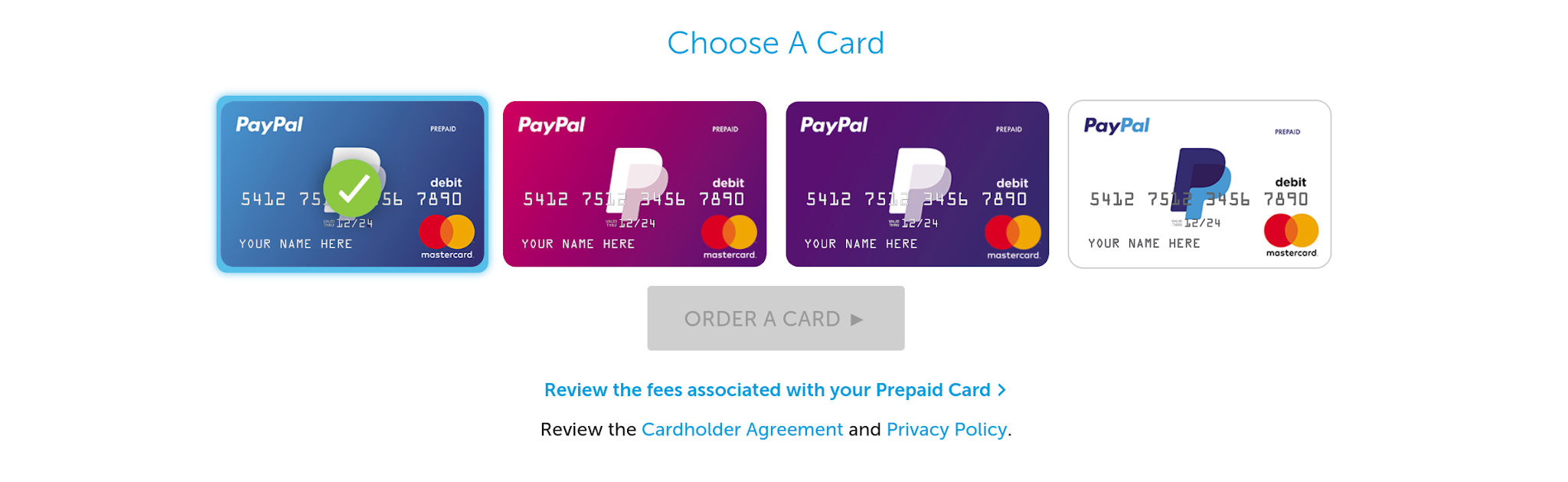

There are two options for opening a PayPal Prepaid MasterCard account: online or in-store. The online sign-up takes less than a minute, as the initial enrollment requires only your name and address. You may also begin direct deposit setup at that time, though the feature is available to you later as well.

The last step in the initial process is selecting your card design.

From there, you’ll receive your card within ten business days, after which you should activate it and link it to your PayPal account. You can then use the card as you would any other MasterCard for in-store and online purchases, as well as bill pay

While the free online sign-up is the most convenient option, you can open a PayPal Prepaid MasterCard account at a participating retailer if you need a card urgently. You’ll purchase a temporary card that you can use immediately, but it will expire within 120 days. After purchasing the temporary card, activate and verify your account so that PayPal will send you a personalized card. The card price varies by retailer, and you can find nearby retailers and see their reload fees using PayPal’s locator tool.

Keep in mind that when you buy the card, you’ll need to add an initial load of $10 or $20, depending where you buy it. Fortunately, you can avoid those minimums in the future through the free deposit methods.

Overall review of PayPal Prepaid MasterCard

The PayPal Prepaid MasterCard provides a solid option for basic banking features such as depositing and withdrawing money. The interest-accruing savings account and cashback rewards are nice ways to boost your balances as well.

Because of the fees associated with the card, however, it’s not a great long-term alternative to traditional banking services. The $15,000 funds cap is also a drawback, particularly if you have your paycheck direct deposited. The PayPal Prepaid MasterCard could serve as a good interim solution for making purchases and paying bills, and it is convenient for transferring money. Ultimately, however, you’ll want to find a prepaid card that has lower fees and richer features or open a more traditional bank account.

What Is Bank Fraud? How to Recognize It, Avoid It and Report It

What Is Bank Fraud? How to Recognize It, Avoid It and Report It How to Open a Bank Account for a Minor

How to Open a Bank Account for a Minor How to Balance a Checkbook

How to Balance a Checkbook Retirement Savings: How Much Should I Save Each Month?

Retirement Savings: How Much Should I Save Each Month?