Survey Says: 59% Who Aren’t Retired Fear They Won’t Get Social Security Benefits

“It’s not like Social Security will be there when I retire, anyways.” You’ve probably heard it before. According to a DepositAccounts survey, chances are you’ve even said it yourself.

Among our nonretired survey respondents, 59% say they’re afraid that Social Security won’t be around by the time they retire. That may pose a problem, as 62% say they could never afford retirement without Social Security.

- Key findings

- Most Americans worry that Social Security won’t last until they retire

- The majority expect to rely on Social Security — except for Gen Z

- Some have cut contributions, though most are small to begin with

- Nonretirees feel behind, but few have boosted contributions in fear of Social Security cuts

- Most Americans don’t support raising the retirement age or cutting Social Security

- Democrats worry more about Social Security than Republicans

- Playing catch-up: Tips if you’re struggling to save for retirement

- Methodology

Key findings

- Retirement dreams are clouded by uncertainty. Most nonretired Americans, 59%, are worried that Social Security won't be available when they’re ready to kick up their heels. This is especially prevalent among Gen Xers, the demographic closest to approaching retirement age, at 70%. Just over half (51%) of Americans have a retirement plan outside of Social Security, including 68% of those earning $100,000 or more per year.

- Social Security isn't just a safety net. More than half (53%) of nonretirees expect to rely on Social Security to live a sustainable retirement. And 62% believe they’ll never be able to retire without Social Security — led again by Gen Xers, at 71%. Still, 77% of nonretirees don’t expect to rely on support from family to retire.

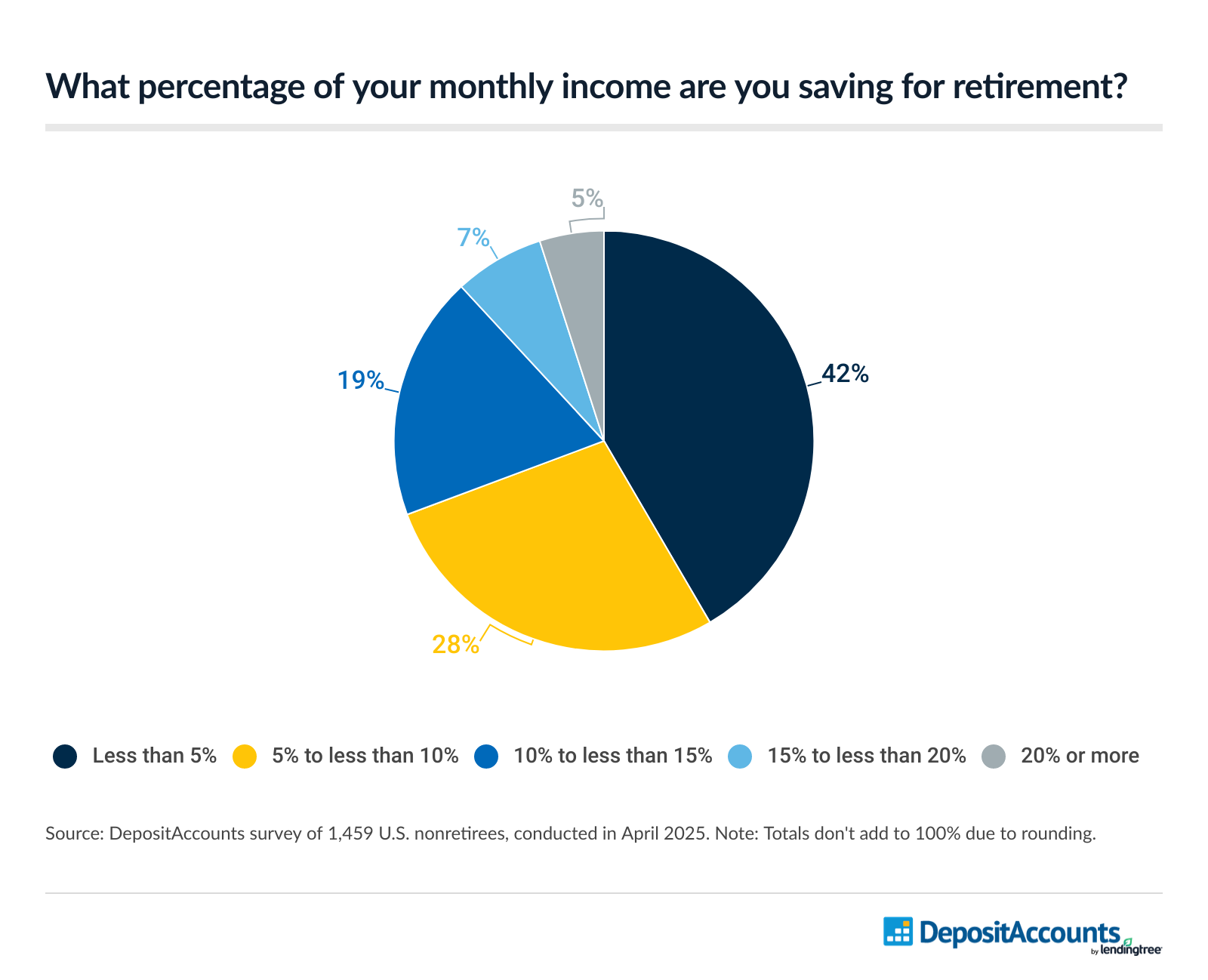

- Faced with financial pressures, some Americans are tightening their belts. Among those with a retirement plan outside Social Security, 38% admit to reducing retirement contributions in the past year. Also, 42% of nonretirees save less than 5% of their monthly income for retirement, while 28% save more than that but less than 10%.

- Some feel behind on retirement but aren’t making changes. More than half (57%) of nonretirees, including 67% of Gen Xers, feel behind on their retirement goals. This feeling isn’t leading to changes, though, because most (74%) haven’t boosted contributions despite fears of Social Security cuts.

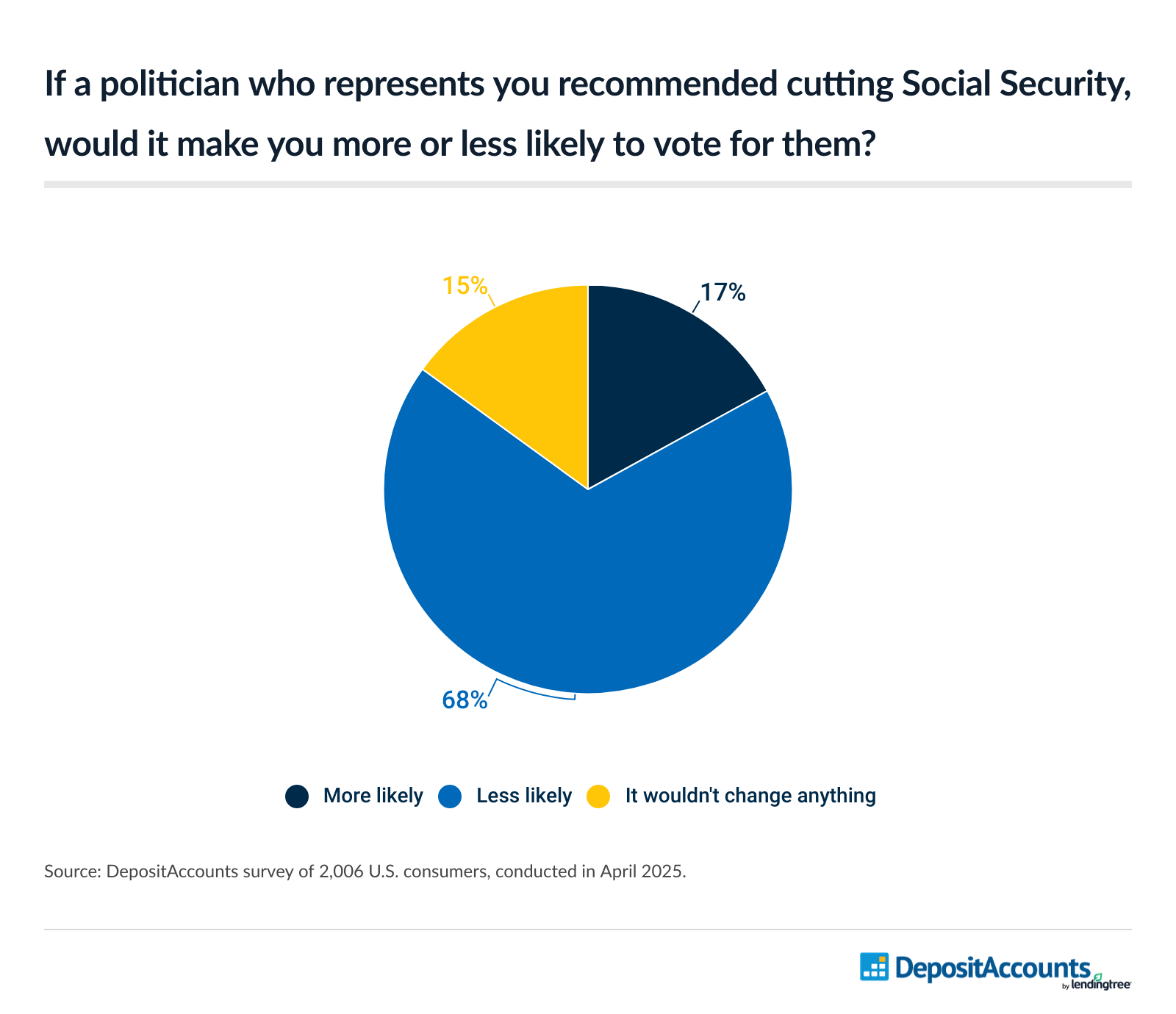

- With Social Security vital, Americans stand firm. Most Americans (68%) don’t support raising the age at which people receive Social Security benefits. The same percentage (68%) say they’d be less likely to vote for a politician who represents them and recommends cutting Social Security. This is especially prevalent among baby boomers (89%) and parents whose children are 18 or older (85%).

- But not all of us are as confident, as Democrats worry more about Social Security than Republicans. Among nonretired Democrats, 64% are worried that Social Security won’t be available when they retire. Independents follow, with 60% concerned. The majority of Republicans are also worried, but a little less so at 54%.

Most Americans worry that Social Security won’t last until they retire

We asked nonretired Americans if they’re worried that Social Security won’t exist when it’s time to retire. More than half (59%) said yes. The most worried are those closest to retirement age (Gen Xers ages 45 to 60), as well as those who make $30,000 to $49,999 a year, women and parents with kids under 18.

We asked Matt Schulz, LendingTree chief consumer analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life,” about these worries, and although he understands the concerns, he says there’s no need to panic.

“It's so important to invest and save toward your retirement beginning as early as possible. But the truth is that it’s highly, highly unlikely that Social Security won't be available when you retire.

“It's possible that funding issues could lead to you not receiving your full benefits, which is certainly troubling, but the possibility that Social Security will disappear altogether before you retire just isn't likely.”

The majority expect to rely on Social Security — except for Gen Z

Over half of our nonretired survey respondents say they expect to rely on Social Security to live a sustainable retirement (53%). Of the generations we surveyed, Gen Zers (ages 18 to 29) are an outlier.

Most Gen Zers (61%) don’t expect to rely on Social Security to sustain retirement, and 55% don’t think they’ll need Social Security to retire at all.

Whether they’re in tune with their finances or just optimistic, 61% of Gen Zers feel that they’re on track with their retirement goals. Gen Z is also the only generation where the majority (52%) don’t support a tax increase to help fund Social Security.

Tangentially, 64% of Gen Zers trust the government with their money, according to an earlier DepositAccounts survey.

For context, most of our survey respondents are at least somewhat familiar with Social Security and how it works:

Millennials among the most likely to have a retirement plan outside of Social Security

We asked our survey respondents if they had a retirement plan other than Social Security, like a 401(k) or Roth IRA. Here’s who has a private retirement plan, broken down by generation.

- Gen Zers: 41%

- Millennials (ages 29 to 44): 55%

- Gen Xers: 48%

- Baby boomers (ages 61 to 79): 53%

It’s possible to save for retirement at any age. Schulz says the key is to start small.

“There's no bigger financial asset than time. The sooner you start saving and investing, the better off you'll be in the long run. Even if you only start with investing and saving a few dollars from every paycheck, if you can consistently get in the habit of doing it, it can pay off in a huge way once retirement comes.”

Some have cut contributions, though most are small to begin with

American household savings dropped 32.5% from 2019 to 2023, according to a DepositAccounts study. A couple of years later, and it looks like 401(k)s and Roth IRAs are also on the chopping block.

Out of our survey respondents who have a private retirement plan, 38% admit to slashing contributions.

Glass half full: The majority haven’t cut back on investing for retirement. But is it because you can’t cut what’s not there? The lion’s share of our nonretired survey respondents contribute less than 5% of their annual income to retirement (42%).

Nonretirees feel behind, but few have boosted contributions in fear of Social Security cuts

Consumers 65 and older spend an average of $57,818 a year, based on a DepositAccounts study. Are you on track for a comfortable retirement? Most say no.

At 57%, more than half of our nonretired respondents say they feel behind on retirement goals. This includes 67% of Gen Xers, the same age demographic most worried about Social Security running out.

Even though most feel behind, few are taking action, as 74% of our nonretired respondents haven’t increased their retirement contributions. At least, not because they’re worried about Social Security.

Reasons for not contributing more vary — 35% of nonretirees can’t afford it and 39% just haven’t thought about it.

Parents of younger kids are a little more cautious. Over a third (36%) of parents with children under 18 bumped up their contributions — twice as many as parents with adult kids and people with no kids (both at 18%).

Most Americans don’t support raising the retirement age or cutting Social Security

If there’s something that most of us can agree on, it's retirement age. The majority (68%) of our survey respondents don’t support raising the retirement age from its current spot at 67.

Americans feel largely the same about slashing benefits. Again, 68% say they would be less likely to vote for a politician who recommends Social Security cuts. Only 15% say the prospect of Social Security cuts doesn’t affect their vote.

Across the aisle, Democrats, Republicans and independents agree — to differing degrees — that they would be less likely to vote for a politician who wants to cut benefits.

Over half of Republicans (58%) say they wouldn’t, compared with 73% of Democrats. Independent voters are the least likely to support cut-friendly politicians, at 76%.

A DepositAccounts study reported that 22% of retirement-age adults were still working in March 2024.

Democrats worry more about Social Security than Republicans

Most of the nonretired Democrats, Republicans and independents we surveyed are concerned about Social Security being unavailable once they retire. Out of the three, Democrats are the most worried (64%), and independents aren’t too far behind, at 60%. With a bit over half (54%), Republicans are the least worried.

Whether Americans support a tax increase to help fund Social Security is about 50/50

More Americans would support a tax increase to bolster Social Security, but not by much. A little more than half (52%) are fine with a hike and 48% aren’t.

Here’s who doesn’t support increased taxes to fund Social Security:

- Women: 52%

- Gen Zers: 52%

- People without kids: 53%

- Republicans: 51%

- Independents: 52%

- Those with annual household incomes below $30,000: 51%

Playing catch-up: Tips if you’re struggling to save for retirement

The 50/30/20 rule says you should put away 20% of your post-tax income toward savings, including retirement. We asked Schulz what advice he’d give to someone struggling to save for retirement. He says:

- Balance paying debt with saving for retirement. Keep your eyes on the prize. Saving at the same time as paying off debt means that you won't reach either of those goals as quickly, but it’s still crucial. Retirement saving is about getting started early and building a habit that lasts a lifetime, ramping up your investments over the years as your income grows. Don't let debt derail your savings entirely because the opportunity cost is simply too great if you do.

- Keep what matters, cut what doesn’t. Smart spending is about prioritization. Spend more on what matters to you and spend less on what doesn't. Looking at your expenses ruthlessly can lead to savings that you may be able to put toward retirement, emergency funds and other major financial goals.

- If anything, get your 401(k) match. For many people, a 401(k) plan with an employer's match is a great place to start saving extra. When you get a match, your company is giving you money above and beyond your salary to invest in your 401(k). Free money is pretty hard to beat, and it can be a great jump start for your retirement savings.

Methodology

DepositAccounts commissioned QuestionPro to conduct an online survey of 2,006 U.S. consumers ages 18 to 79 from April 8 to 14, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79

What Is Bank Fraud? How to Recognize It, Avoid It and Report It

What Is Bank Fraud? How to Recognize It, Avoid It and Report It How to Open a Bank Account for a Minor

How to Open a Bank Account for a Minor How to Balance a Checkbook

How to Balance a Checkbook Retirement Savings: How Much Should I Save Each Month?

Retirement Savings: How Much Should I Save Each Month?