The Current State of Banks and Credit Unions

The pace of bank closings has slowed in recent weeks, and this is generally seen as a good sign. However, just because bank closings have been slowing, it doesn’t mean that they are in better financial shape. Indeed, banks have been struggling quite a bit since the financial crisis, and it appears that some of them are not quite on firm footing, even two years after the crisis. And if you look at the infographic below, you might conclude that banks overall are actually in worse financial shape in 2010 than they were in 2009.

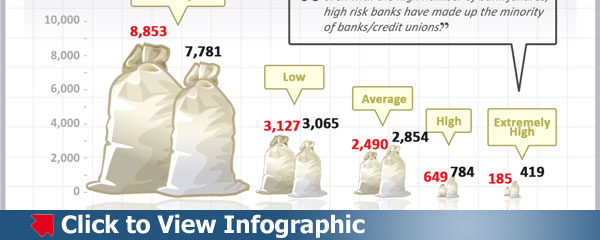

Looking at the infographic, you can see that there are more banks in categories of average to extremely high risk in 2010 than in 2009. As a whole, it appears as thought the banking industry is still struggling, and struggling more this year than last year. In 2009, at this time of the year, only 185 banks were considered to be at extremely high risk. This year, though, there are 419 banks in that category. The number of banks with extremely low risk has dropped from 8,853 to 7,781. For many banks, the fallout from the financial crisis continues, and translates into consequences for the rest of us. With low yields on deposits, and credit still tight, many are finding that they are at a disadvantage right now when it comes to some of the services they use from financial institutions. Savers are especially feeling the effects as rates continue near record lows on deposits.

Even with this statistic looming, though, it is worth noting that high risk banks still make a small minority of total banks. There are about 15,000 banks and credit unions in the country, and the fact that only 1,203 of them are considered to be either high risk or extremely high risk, does speak to the overall health of banks in general. Indeed, more than half of the banks in the U.S. are in the “extremely low” risk category. Most banks and credit unions are in good shape, but it doesn’t hurt to check the health of your bank, just to make sure that your bank or credit union isn’t in the high risk category. One thing the financial crisis taught us is that no financial institution is immune from money problems.

Why Some Banks Are Too Big To Fail

If most of the banks and credit unions in the country are in pretty decent shape, then why were government leaders and the Federal Reserve so bent out of shape over a few banks that they considered “too big to fail”? If you look at the infographic, you will see why: Many of the banks that received bailout help really are too big to fail. The infographic shows that almost half of the deposits in the U.S. are held by 10 banks. The quote on the infographic sums it up quite neatly:

“Small banks greatly outnumber the giant banks, but the 10 biggest alone hold nearly as much money as the remaining…”

When you consider the large amounts of deposits held by the biggest banks, the thought of them failing becomes somewhat daunting – especially when you consider that the government could then become responsible for covering the deposits at those banks. Bailing out the big banks with loans that they paid back was a move that the government thought necessary because of the potential impact failures on that scale could have had on the economy.

These big banks received loans that helped them remain solvent. Additionally, in some cases (notably Citi) the government actually bought stock, which was later sold. The government also bought up some of their bad loans, and even bought stock in some of these banks, helping to improve balance sheets. Additionally, some of the biggest banks have also seen big profits so far in 2010, helping them improve their fiscal stability.

Even with this appearance of financial stability, though, there is a chance that we could see these problems again, especially if the biggest banks start taking big risks again. Some have argued that smaller banks and credit unions might be better options for your money. It appears that, in some cases, smaller banks and credit unions might be in better financial shape than some of the banks that are bigger than they are. Perhaps it’s because the smaller banks just don’t have the resources to take bigger risks, and that forces them to be a little more conservative with their money decisions. This is one of the reasons that the Move Your Money campaign is starting to pick up steam. After the financial crisis, and after seeing what happens when banks are too big to fail, some are choosing to take their money to local financial institutions.

Are Credit Unions a Better Choice?

In light of some of the news about these big banks, some are starting to think that credit unions might be a better choice. Some feel that credit unions might be better options, since they appear – overall – to be in better financial shape than banks in general. Credit unions are largely community based, which adds some appeal in a culture that is in a state of backlash against big, national banks (especially those that got special help from the government and the Fed).

Others cite the sometimes better yields and lower interest rates on loans as reasons to use credit unions and shun banks. However, others are a little more skeptical. Because of the local nature of credit unions, using a credit union can mean that you have a hard time accessing your money when you are out of town. (You can check to see if your credit union is part of a nationwide co-op for better, fee-free access to your money.)

No matter where you choose to take your money, though, it is clear that you do need to be careful. Check to see that your deposits are properly insured so that you don’t lose your money if the bank or credit union fails. Most financial institutions, though, are considered to be on firm financial footing. You just need to watch out for the few banks that are still in poor shape.

5 Easiest Bank Accounts to Open Online

5 Easiest Bank Accounts to Open Online What Is Bank Fraud? How to Recognize It, Avoid It and Report It

What Is Bank Fraud? How to Recognize It, Avoid It and Report It How to Open a Bank Account for a Minor

How to Open a Bank Account for a Minor How to Balance a Checkbook

How to Balance a Checkbook