Major Credit Union Project (and New CU Resources) at DepositAccounts

Over the past year, we embarked on a major behind-the-scenes categorization project covering the almost six thousand federally-insured credit unions in the United States.

As many readers know, each credit union maintains its own unique set of field of membership requirements as part of its charter. These membership requirements dictate who can join the credit union and on what basis, and they can vary greatly from one credit union to the next, each one with its own nuances.

As many readers know, understanding (and properly categorizing) these field of membership requirements – including the occasional back-door means of qualifying – can mean the difference between capitalizing on an exceptional deal or missing out.

An Overview of the Project

Historically, we at DepositAccounts have dichotomized credit unions into two groups: i) easy membership (i.e. most anyone in the nation can join), or ii) restrictive (i.e. limited to only those from a select location or who work or otherwise participate in a select industry or at a select organization). The second group simply consisted of every credit union that we had not identified as falling into the first group. Along with these classifications, we also maintained database records, based on our own research, of which states’ residents were eligible to join each credit union – for both in-person applicants and online applicants.

As part of the categorization project we have embarked on over the last year, we have sought to manually review, categorize, and programmatically track - on an ongoing basis - the field of membership requirements for the vast majority of the nation’s credit unions (all but the very smallest credit unions who don’t maintain an online presence). We looked at various resources available in this area – including from the NCUA and from some of the credit union industry’s other major websites – and found that nothing covered this information in a way that would be useful to our audience of deal seekers. The only way to truly index this critical eligibility component of the nation’s credit unions was to do it ourselves and to do it manually (with the ongoing indexing help of our technology).

New Credit Union Tools and Resources

After almost a year of hard work from our data team, we are now happy to bring these new categorizations to bear on several related credit union resources on the site! Some of these resources are brand new outputs from this project (e.g. a new Credit Union Finder tool), and some are refreshes of existing resources (e.g. new filters on the rate tables).

We still have plenty of ongoing work to be done in this area – many of our regular readers know how inexact of a science it can be to pin down the exact interpretations on some of these stated field of membership requirements. But in the meantime, we hope that these categorizations – and most importantly, the tools that are derived from them – help to serve you in finding the credit unions you are eligible to join, and out of those credit unions, the ones with the best deposit product offerings and rates for your saving goals.

Here are some of the updated and new tools that flow from this project:

New Big List of Credit Unions Anyone Can Join

First, we did a major upgrade of the old “Big List of Credit Unions Anyone Can Join." The list has become a sortable table that’s tied in with our credit union database. You can access the list here.

As you can see in the new “Big List,” the table is divided into four columns that include the credit union logo, the name and headquarters, the asset size and the number of branches. You can sort the table by clicking on the column titles. By default, the table is sorted based on asset size.

For each credit union, select the “How you qualify” link, and a box will pop up displaying a summary of the credit union’s membership requirements. The association that can be used to qualify for membership should be listed first.

I started the “Big List” in 2011 as a way to keep track of all of the credit unions that offered a way for people in any state to become members. Typically, anyone can join these credit unions by first joining an association for a small fee. Sometimes the credit union even allows applicants to join the association as part of the credit union’s online membership process. Most of the time, applicants must first join the association on their own before applying for credit union membership. I often say these credit unions have “easy membership requirements.” That doesn’t mean the application process is easy. It just means that it’s easy for someone to qualify for credit union membership.

It’s important to remember that this “Big List” table is in constant flux. As some credit unions have made it easier for people to join by adding associations, others have added restrictions on membership. For example, we have seen cases in which credit unions added a requirement that an applicant had to not only be a member of a certain association but also had to reside in specific states. If you see that a credit union should be added or removed from the list, please leave a comment at the bottom of the “Big List” table.

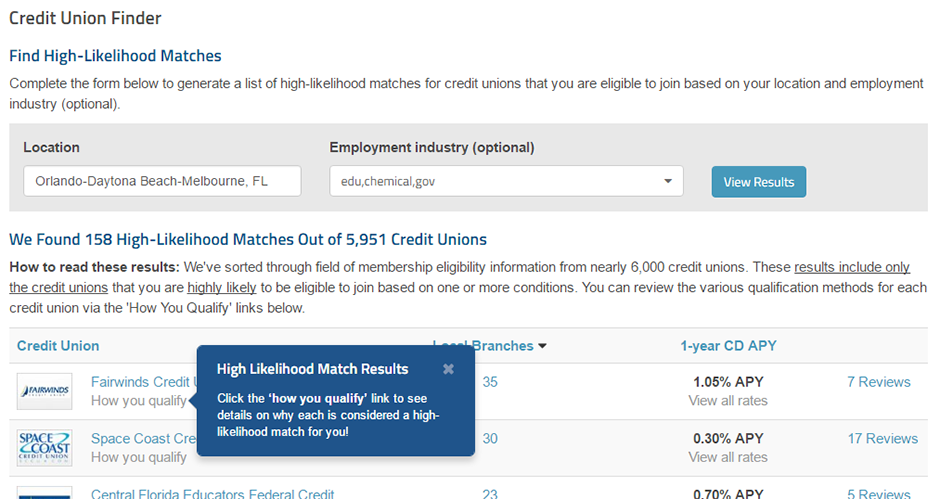

Credit Union Finder

In addition to the “Easy Membership Requirements” credit unions, there are typically many other credit unions you can easily join based on where you live or work. To help you find these, we developed the Credit Union Finder Tool.

To use the Credit Union Finder Tool, just type in your zip code in the location box, and the corresponding metro area should pop up for selection. With just this selection, the tool will return all national ‘easy membership’ credit unions along with all local credit unions that are open to anyone that lives, works, or worships in that region of the state.

Furthermore, if you think you may be able to join a more restrictive credit union based on the industry in which you work, select the “employment industry” box (this is optional). Then select one or more industries that you think may apply to you. Click “View Results,” and the tool will list high-likelihood matches for credit unions that you are eligible to join based on your location and employment industry.

For each credit union listed in the results, you will see a ‘How you qualify’ link. Clicking on this link will show you a popup snippet of the field of membership requirements language for that particular credit union, along with a link to the full field of membership requirements page on that credit union’s own website.

As you will see, the results list is placed in a sortable table format. By default, the credit unions with the most branches in your area will be listed on top. The national “easy membership requirement” credit unions with no branches in your area will be listed on the bottom. You can also sort them alphabetically or based on the highest 1-year CD rate. For simplicity, we decided to use the 1-year CD rate as the best product proxy for the competitiveness of that credit union’s rates. You can click through on each credit union’s name to see the full listing of products and rates for that credit union.

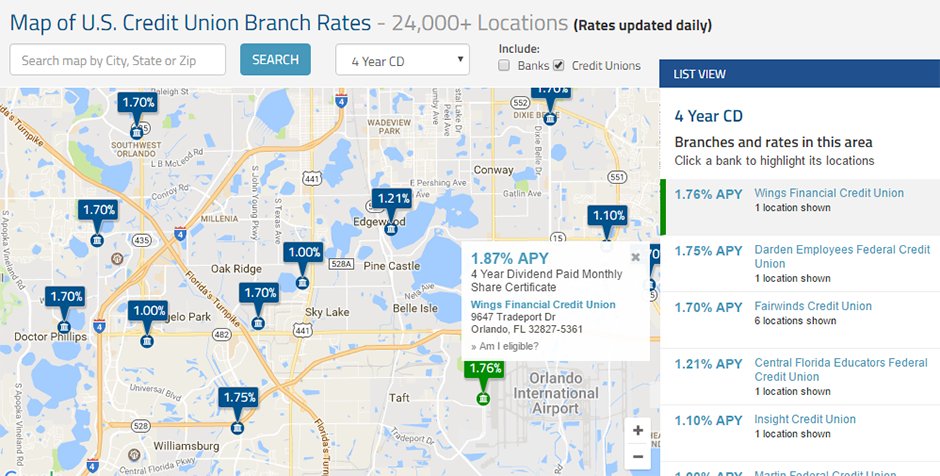

Credit Union Rates Map

If you want to find nearby credit unions that offer the best rates, you can use our Map of Credit Union Branch Rates. In late 2015 we released the Rates Map Tool to help readers locate local bank and credit union branches that offer the highest rates on various deposit products. We did a slight enhancement to this tool by allowing the user to view only credit unions or only banks in addition to both banks and credit unions.

The Rates Map Tool should by default show your local area. You can change this by entering your city or zip code in the search box. The default product shown is the 1-year CD. You can change this to one of many other products, including high-yield reward checking accounts.

Improved Credit Union Filters in the Rate Tables

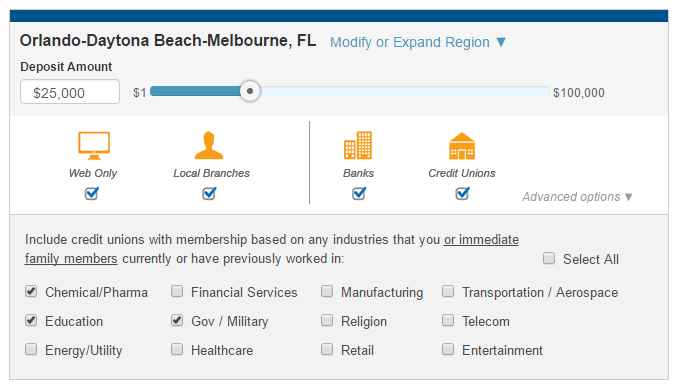

The filter developed for the Credit Union Finder has been applied to the Rate Tables. This filter is the box above each rate table. By default, the filter is set to show all credit unions and banks that will most likely allow you to open an account. These results now include by default both national “easy membership requirement” credit unions as well as local credit unions that are open to most anyone in your selected geographic region of the state.

As a reminder, with the “web only” filter checked, the “easy membership requirement” credit unions that don’t have local branches will be included. With the “local branches” filter checked, credit unions that have local branches and that have geographic-based fields of membership are included. To find additional local credit unions that have fields of membership that are primarily employer or industry-based, click on “Advanced options.” Then select one or more industries related to your employer or organizations with which you or your family is associated.

List of the Largest Credit Unions in the United States

Last year we added a new table that allows you to view and sort based on asset size of the largest banks and credit unions, on either a national level or a state level. Since you can choose to show only credit unions, I thought this would be a useful resource to include in this post. Here’s the direct link to the table configured to show the nation’s largest credit unions. In addition to sorting by asset size, you can also sort based on the number of branches, the number of states where the credit union has branches, the number of employees and the number of member accounts.

Our New Master Credit Union Page

You can access all three of the above credit union resources in our new credit union overview page. This page is designed to group together all of the important information on credit unions. Those who are new to credit unions should find it informative. Long-time readers should find the links to the credit union resources and articles most useful.

Let Us Know Your Thoughts!

As I said above, this project is ongoing as we continue to update information and refine our data processes around it. You can think of this initial release as a Beta version of sorts. So please let us know your thoughts and findings as you peruse these new tools!

What Is Bank Fraud? How to Recognize It, Avoid It and Report It

What Is Bank Fraud? How to Recognize It, Avoid It and Report It How to Open a Bank Account for a Minor

How to Open a Bank Account for a Minor How to Balance a Checkbook

How to Balance a Checkbook Retirement Savings: How Much Should I Save Each Month?

Retirement Savings: How Much Should I Save Each Month?