New Free Checking Finder Tool on DepositAccounts

As many readers know, a major focus here at DepositAccounts has always been on tracking and organizing as much helpful data as we can gather on banks, credit unions, and their deposit products. This focus (and the technology that drives this initiative) has resulted in a very large data set – which includes more than a quarter million rates, as featured by our rate tables – and the discovery of many of the attractive deals that we cover here on the Bank Deals Blog.

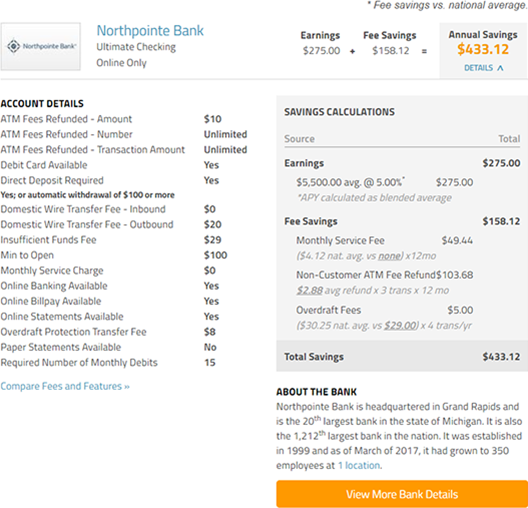

One less publicized aspect of our team’s data collection efforts pertains to the account attributes we monitor for many accounts. These attributes include many of the key factors to consider when opening an account such as monthly service charges, ATM fees, min/max amounts, early withdrawal penalties, and account features. These attributes are visible whenever you expand the account details on any of our rate tables (by clicking the ‘details’ dropdown arrow to the right side of the listing) and in our tools, such as our CD Early Withdrawal Calculator.

Today we’re introducing a Free Checking Finder tool that utilizes both our rate and attribute data to help consumers find the best checking account based on their particular banking behaviors. Interest rates play a big role in determining the overall value of a checking account, but they don’t tell the whole story, and for many Americans, they play only a small part.

Depending on the amount you deposit and how you typically use your checking account, you may be best served by one that offers a high rate on your entire balance, a reward checking account that offers high rates up to a limit as long as you use your debit card, or a cash back checking account that offers cash back on purchases. Or, if you are like most Americans, who overdraft your account on occasion or use ATMs from other banks, you could easily save far more by finding a bank or credit union with extremely low fees than you would by focusing on the highest interest rate.

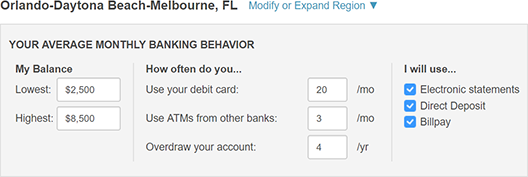

Until now you would have to search through each of the checking rate tables and their individual results and calculate the total return yourself. Our new free checking finder tool allows you to answer eight questions about your normal banking behavior and suggests the accounts that suit you best rather than ones that require you to change your behavior to maximize returns.

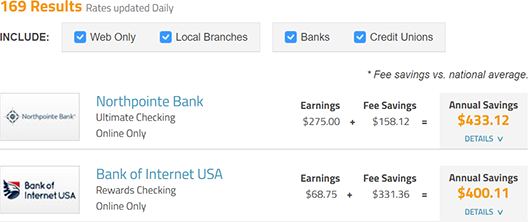

Once you have entered your typical behavior, the tool will search all eligible checking accounts and rank them by total annual savings. The total annual savings includes the interest earnings and the total fee savings vs the national average. It is not unusual for one with an exceptional interest rate and below average fees to be followed by another with an above average rate and exceptionally low fees, depending on your criteria.

Breaking Down the Savings

Each row includes a details link that you can click to view a full break-down of how the annual savings is calculated, along with the additional account attribute data we have on file.

Even in the current low interest rate environment, it is still possible for most people to find a checking account that will significantly increase savings. We hope this tool will help you to locate these gems without having to spend hours reading the fine print.

5 Easiest Bank Accounts to Open Online

5 Easiest Bank Accounts to Open Online What Is Bank Fraud? How to Recognize It, Avoid It and Report It

What Is Bank Fraud? How to Recognize It, Avoid It and Report It How to Open a Bank Account for a Minor

How to Open a Bank Account for a Minor How to Balance a Checkbook

How to Balance a Checkbook