Has Your Bank Quietly Cut Your Interest Rate?

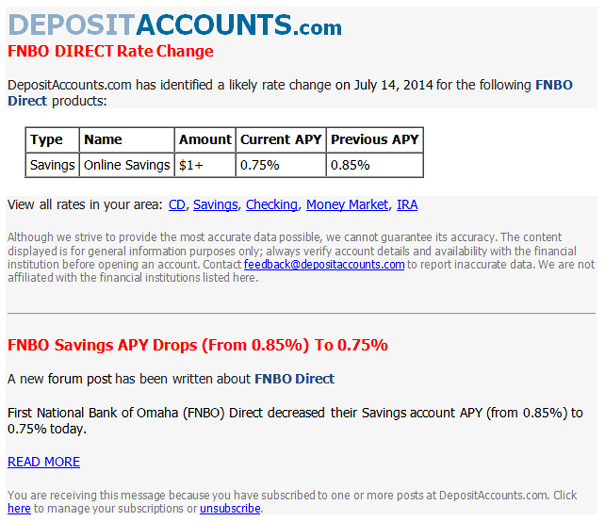

When a bank cuts its savings account or checking account rate, it’s common for the bank to quietly cut the rate without any customer notification. That’s what happened in July at FNBO Direct when its online savings account rate fell from 0.85% to 0.75%. Several DA readers noticed the rate cut a few weeks after the rate fell, and they weren’t happy about both the rate cut and the lack of notification from the bank. FNBO Direct wasn’t quiet when it raised the online savings account rate last year.

If you want to stay on top of the latest rate cuts at your banks and credit unions, DepositAccounts.com can help. Two years ago we added the bank alerts service. This free service allows you to select the banks and credit unions you want to be notified about. When we find that a rate change has occurred for any account at one of your selected institutions, you will receive an email alert of that change. In addition to rate changes, you can also enable alerts when a new blog post is written about your institution or when there's a new user bank review or comment in the forum pertaining to that institution. If multiple rate changes, blog posts or forum threads occur in a single day for that institution, they will be grouped together in a single email.

Even though our technology automatically tracks approximately 275,000 rates from roughly 8,000 banks and credit unions, we don't track rates for all institutions. So our rate alerts are only applicable for those institutions which we track (you can determine whether we automatically track the rates on your specific institution(s)'s products by looking up your institution in the Bank's Rates page - if you don't see "no rates posted at this time", then we track them). Alerts related to blog posts, user reviews, and forum threads will still be available for those institutions for whom we don't have active rate data).

Another thing to keep in mind is that rate alerts may be delayed for up to a day or two after they are made on the bank's website before an email is sent (and in select cases, longer than two days). We want to make sure that the rate changes are accurate before an email is sent, so this takes some extra time. Of course, some banks are occasionally late in posting their new rates, or they may not even post their new rates. In those less frequent cases, there could be a delay even beyond the one-day period.

How to Set Up an Email Alert

With these limitations in mind, here’s how to set up an email alert:

First Method

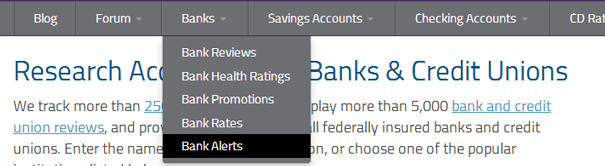

The first step is to find your bank or credit union. Select "Banks" in the main navigation menu and "Bank Alerts" in the sub menu.

In the "Bank Alerts" page, enter the name of your bank or credit union in the search box.

The results of the search should list your bank or credit union. You can then select the "Receive Alerts" link as shown below.

After you select "Receive Alerts" link, a box should open up that allows you to select the type of alerts that you want to receive. Options include "Rate Changes", "Blog Posts" and "User Reviews".

Second Method

You can also enable a bank alert from our hub page for your bank or credit union. This is shown below for FNBO Direct.

Managing Your Alerts

When registering for alerts, you’ll need to enter the email address to which you want the alerts to come. If that email address is not already associated with a registered DepositAccounts member profile, then you will receive a validation email at that email address upon requesting to receive alerts. If that email address is already associated with your registered DepositAccounts member profile, then you’ll just need to make sure that you have email alerts enabled in your control panel settings. If at any time in the future, you no longer want to receive a bank alert, you can disable the alert in the DA control panel or by clicking unsubscribe at the bottom of an email alert.

Stay on Top of Your Bank's Rate Cuts

Banks often try to attract deposits by offering top rates, but few banks will keep their rates on top. Many banks try to be sneaky about the rate cuts. They hope most customers don't pay attention, and will just let their money sit as rates are cut. In today's low rate environment, it's more important than ever that savers pay attention to rate cuts so they can move their money to the banks and credit unions paying the highest interest rates. Our Bank Alerts can help you stay on top of those rate cuts.

5 Easiest Bank Accounts to Open Online

5 Easiest Bank Accounts to Open Online What Is Bank Fraud? How to Recognize It, Avoid It and Report It

What Is Bank Fraud? How to Recognize It, Avoid It and Report It How to Open a Bank Account for a Minor

How to Open a Bank Account for a Minor How to Balance a Checkbook

How to Balance a Checkbook