Review of Clarity Money

If you’re looking for greater insight into your finances, there’s an app for that — specifically, Clarity Money. Acquired in 2018 by Goldman Sachs Bank USA, Clarity Money is now part of Marcus by Goldman Sachs®, the bank’s consumer-facing brand.

Clarity Money offers an intuitive, affordable means of tracking your expenses. The app’s standout feature is the option to cancel recurring subscriptions through the platform. Clarity Money will highlight expenses such as streaming services to ensure that you’re aware of those costs, which are easy to forget about month-to-month but which also really add up during the course of a year.

Where this app falls short is in the customization department. Though you may receive product recommendations relevant to your specific circumstances and can also categorize and exclude transactions as needed, there aren’t robust budget creation and customization options for all users.

What is Clarity Money?

The app is a budgeting and money management tool that provides an overview of your finances through a dashboard of your linked financial accounts, such as checking accounts, savings accounts and credit cards. The dashboard also includes breakdowns of where your money goes each month. Using artificial intelligence and machine learning, it analyzes your income and monthly expenses to help you create a discretionary budget and identify ways to save money.

The program uses the same data to recommend financial products based on your financial circumstances, such as loans and the Marcus high-yield savings account, which consistently ranks on our list of the best online savings accounts. For instance, if you’ve linked savings accounts from other banks, Clarity Money might recommend a Marcus account if there’s an opportunity for a higher yield. Or, depending on the types of accounts you use, you might receive a recommendation for the Acorns investing platform.

It also highlights recurring subscriptions, such as Netflix and Hulu, and asks whether you’d like to cancel those to save money. If you’re willing to live without Netflix originals, you can give the app permission to cancel those accounts for you and reduce your recurring expenses.

Clarity Money savings account

Clarity Money does not offer its own savings account, but users can apply for a Marcus high-yield savings account through the Clarity Money app. However, you don’t need to sign up for Clarity Money in order to use Marcus. The Marcus savings account has a 2% annual percentage yield (APY) as of the date of publishing.

Like Clarity Money, Marcus savings accounts are free to create, and the company doesn’t charge service or transaction fees on money transfers to other banks. Note, however, that the bank from or to which you’re transferring money may charge fees. As of this writing, online outgoing transfers were capped at $125,000 a month.

Marcus savings accounts are FDIC-insured up to $250,000, and you’re allowed up to six withdrawals each month.

How does Clarity Money work?

Creating an account is simple and straightforward. You can sign up through the Clarity Money website or app, which is available for both iOS and Android. In either case, you’ll fill out a short sign-up form with your full name and email address.

Web sign-up

App sign-up

The sign-up process takes under a minute, after which you’ll be able to link your bank accounts. Linking is straightforward but somewhat time-consuming if you have more than a couple of accounts to add.

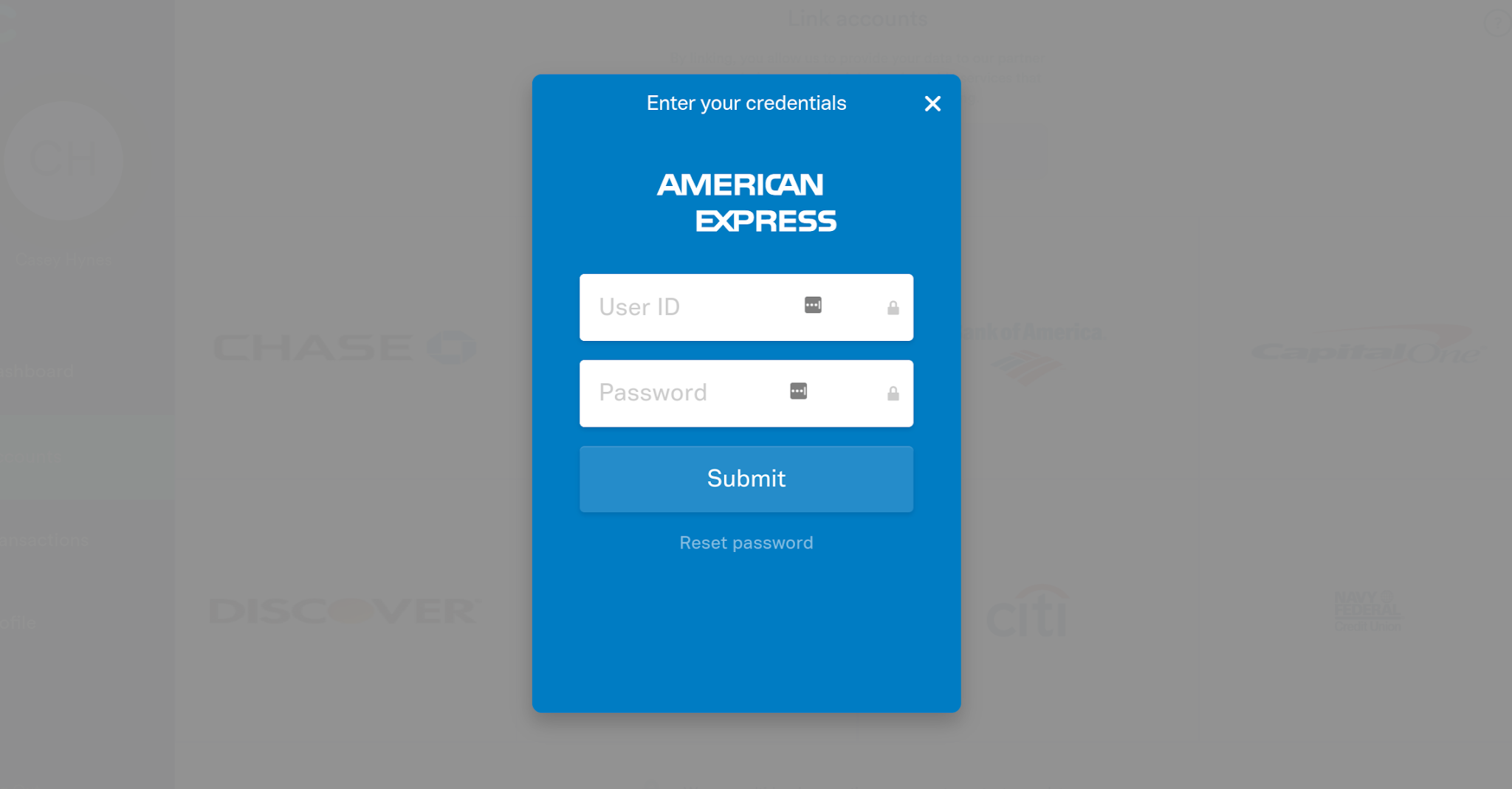

If you link your accounts via the website, you’ll need to input your log-in credentials for each account that you want to connect.

If you link accounts through the app, you’ll be directed to each bank’s website, where you will log in and authorize Clarity Money to pull your data from that third-party institution. In cases where you have multiple accounts with a bank, such as a checking and a savings account, you’ll need to select which ones you want to import to the app. After you’ve given your authorization, you’ll be taken back to the app.

The account linking process may seem tedious, but it’s easy to get through. Set aside 10 to 20 minutes, depending on how many accounts you have, and knock them out all at once. Your recent transactions and spending summaries will show up in your dashboard right away.

Once you’ve set up your accounts, you’ll want to add your income so you can start budgeting. Then check out your dashboard, where you can view all of your recent activity. The dashboard is populated by cards that show spending summaries, upcoming payments, insights on your credit usage, product recommendations, and other information. It’s intuitive to navigate, and the direct, friendly messaging helps you know what your next best steps are for account and money management. You also have the option of categorizing your transactions to improve your budget’s accuracy.

How much does Clarity Money cost?

The accounts are free to create and use. The company earns money if you use a recommended Goldman Sachs Bank USA loan product, and it may also earn referral fees if you use a partner company’s recommended product.

Who should use Clarity Money?

This app is useful for anyone who needs a wake-up call as to where their money goes every month. The visual representations of your spending make it easy to understand what you’ve been spending your money on, and the option to cancel subscriptions is particularly useful. Once you’ve grabbed that low-hanging fruit, Clarity Money continues to be useful for ongoing tracking of your budget.

Rather than a one-off app, the more you use Clarity Money, the more helpful it’s likely to become. As the algorithm collects information on your income and expenses, it can recommend relevant products and useful content to help you make decisions at various stages of your life.

The app is only useful if you bank in the United States, as only U.S.-based banks that deal in U.S. dollars are supported.

Is Clarity Money safe to use?

The app uses multi-factor authentication to verify your information when you set up your account and when you link your financial accounts. The site also encrypts your information so that even the data scientists working on the algorithms cannot see any personally identifiable information. When you open the app on your phone, you’ll need to provide authentication as well, whether that’s a passcode, fingerprint or face ID.

The app also prohibits you from taking screenshots of the app, which is inconvenient if you need a quick snap of your account but reassuring from a security perspective. While it’s not foolproof for preventing someone from accessing your data, it’s one less way that your private financial information can fall into someone else’s hands.

The pros and cons of Clarity Money

Pros:

- Cost: You can’t beat free, and the lack of sign-up and user fees makes the app accessible to anyone who wants to improve their budgeting habits today. The Marcus high-yield savings account is also accessible cost-wise, as there is no minimum deposit requirement. But you must add some amount, even if it’s only $1, within 60 days in order to keep the savings account open.

- Ease of use: Creating a Clarity Money account takes less than a minute, though linking your financial accounts takes a bit longer. However, the process is simple and intuitive. You can also set up notifications for spending updates, upcoming bill payments and low checking account balances so you’re always aware of what’s going on with your money.

- Subscription cancellation: Monthly subscriptions can eat up more of your budget than you realize, especially if you’ve forgotten about them. The app makes you aware of how much you’re spending each month and makes it easy to reduce your expenses by canceling subscriptions for you.

- Product recommendations: When you’re used to paying on high-interest debts every month, you can forget that there are options for easing your payments burden. The machine learning algorithm behind Clarity Money can analyze your expenses and recommend loans to help you consolidate or reduce your debt payments. For example, it might flag high monthly payments associated with high-interest debt and then recommend a loan that may have a lower interest rate.

- Track your credit score: Knowing your credit score gives you a sense of whether you’ll be able to qualify for financing and how likely you are to receive a competitive rate. The app enables you to sign up for monthly updates on your Experian credit score. Although this doesn’t reflect the exact number lenders will see when you apply for loans, it will provide some insights into how your credit usage and behaviors are impacting your overall financial stability.

Cons:

- Not all financial institutions are supported: Although you can link to more than 9,000 financial institutions, you may run into a situation in which some of your accounts aren’t supported. You can sign up for notifications if and when those accounts can be added. But until then, you won’t be able to include them in your dashboard.

- Some features are only available on iOS: While the app is available on both iOS and Android, some features are only available to Apple users. These include a weekly budgeting feature, in which you can set weekly budget categories, and the ability to request loan options from Even Financial. However, both features will eventually be rolled out to Android users as well.

The option to rename credit cards — useful if you have multiple cards with one bank — is also only available to iOS users with Chase Bank credit cards.

- Bill negotiation is no longer a feature: Clarity Money used to negotiate down users’ monthly bills in exchange for a commission on the savings, but it no longer offers that service.

- No personalized coaching: The app does not offer access to individual financial coaching, which can be helpful when you’re confused about your budget or overwhelmed by how to manage your money.

- Less customizable than other budgeting apps: While Clarity Money does allow you categorize your transactions, it offers less flexible and customizable budget creation options than other apps, such as YNAB. The new weekly budget feature will be helpful on that front, though, again, that’s only available to iOS users at this time.

How does Clarity Money stack up to the competition?

Overall, Clarity Money is a solid option for budgeting and identifying ways to save. However, it falls short compared with more robust apps such as Trim, which allows account access for more than 15,000 financial institutions and which offers bill negotiation, a feature that this app no longer offers. Empower is another budgeting app that provides similar features to Clarity Money, but also provides 24/7 access to AI and human financial coaches, as well as a checking account with a 1.90% APY, as of the date of publishing.

Still, Clarity is a useful and user-friendly service, and it’s especially appealing if you’re already a Marcus customer and prefer to work with a familiar brand.

What Is Bank Fraud? How to Recognize It, Avoid It and Report It

What Is Bank Fraud? How to Recognize It, Avoid It and Report It How to Open a Bank Account for a Minor

How to Open a Bank Account for a Minor How to Balance a Checkbook

How to Balance a Checkbook Retirement Savings: How Much Should I Save Each Month?

Retirement Savings: How Much Should I Save Each Month?