10,000th Post Milestone - Look Back at 8 Years of Bank Deals and News

We’re celebrating a milestone today. This is the 10,000th blog post since I started the Bank Deals Blog in August 2005.

Thanks so much to all of you who have been regular readers and commenters throughout the years.

I started the Bank Deals Blog over eight years ago in August 2005. As a fellow saver, I was always on the lookout for bank deals. In 2005 I decided to start this blog to help others find those deals and to encourage collaboration among savers to help each other find the deals and to learn about the various issues and gotchas. The blog and the readership grew more than I could have ever imagined. In 2009 when I was offered a partnership, I decided it was a great opportunity to grow the blog into an even more useful resource. That’s when the Bank Deals Blog at Blogger was converted into DepositAccounts.com, a self-hosted website that allowed for features like rate tables, a bank database, and a discussion forum. In addition to rates, the bank database holds financial health data, branch locations and user ratings.

Over the history of the website, users have posted over 75,000 blog comments or forum posts. We're now tracking almost 300,000 rates from thousands of banks and credit unions. When rates change, readers can be automatically notified by email through our bank alert system. Readers have signed up for more than 6,000 bank alerts.

I thought it would be interesting to look back at some of the past deals and news mentioned at DepositAccounts.com over the eight years.

What Were Your Favorite Deals?

Before I review the past deals and news, I want to ask you to recall your favorite deals that you learned about from DepositAccounts.com. Did the deal turn out to be as good as it sounded? Also, how has the website helped you with your savings? Please leave a comment. Your testimonies would be greatly appreciated.

CDs vs Stock Market

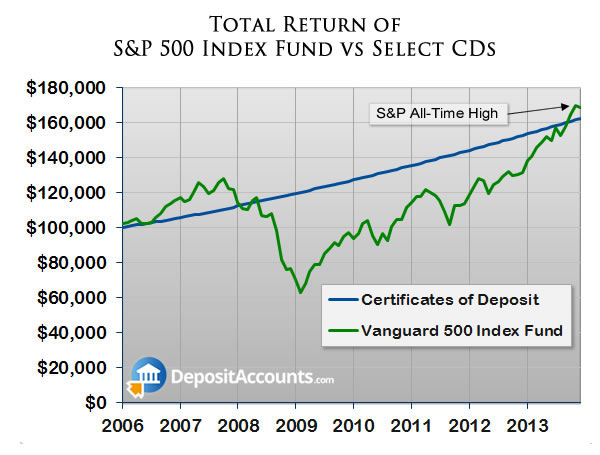

I know most financial planners will stress how important it is to invest in stocks for long-term growth. Those who invest in stocks will have to be prepared for risk and volatility. We saw this back in 2008 and 2009 when the stock market tanked. You may not want to invest all of your savings in CDs, but for the part you want to keep safe, CDs can offer reasonable gains without any risk. And if you use DepositAccounts.com to find the best deals, your CD returns can be improved without any additional risk.

I thought it would be interesting to compare an investment in select CDs with a stock market investment. The following chart compares the performance of two investments made about eight years ago when this blog started. The first is a $100,000 investment in the Vanguard S&P 500 Index Fund. The performance shown for this investment includes appreciation and dividend reinvestment.

The second is a $100,000 investment in select CDs. Instead of using past average CD rates, I chose CDs that were nationally available and had top rates. The first CD I chose was offered at Patelco Credit Union in January 2006. It had a 5.00% APY and a term of 12 months. When that CD matured, the PenFed CDs with a 6.25% APY became available. So the second CD I chose was a 7-year PenFed CD with a 6.25% APY.

Even with this year’s big stock market gains, the total return of the CD investment is pretty close to the stock market investment. The primary difference is that the CD investment only grew. The value didn’t plummet like the S&P index fund did in 2008 and 2009.

Deals and News Back in 2005

My first blog post was "Online Banks Battle For Our Dollars" in August 2005, and the post had a review of three online banks: ING DIRECT, EmigrantDirect and HSBC. It’s interesting to see how things have changed since then. ING DIRECT is now Capital One 360, and like eight years ago, it still offers competitive rates. Since 2005, Emigrant Bank added two more internet divisions: DollarSavingsDirect and MySavingsDirect. All three offer internet savings accounts, but only MySavingsDirect has a competitive rate. Finally, HSBC has essentially given up on its internet savings account. The rate has dropped to an uncompetitive level of only 0.05%.

The big news at the end of August 2005 was Hurricane Katrina. One bank made news about what it did after the hurricane. EmigrantDirect issued gifts of $1,000 to all of its customers affected by Hurricane Katrina.

Past Savings and Money Market Account Deals

The interest rate environment has been tough on savers over the last six years, but there have been a few good savings account deals. The best ones offered not only a top rate but a rate guarantee for a certain period of time.

One of the first nationwide deals I reported on was at ING DIRECT. In early 2006 it launched the Winter Save Up Sale which guaranteed 4.75% on new money in its savings account through April 15.

In 2007 HSBC’s internet division HSBC Direct ran a promotion that was very similar to ING’s Winter Save Up Sale, but the promo rate was higher. HSBC guaranteed 6.00% APY on new money in its online savings account until April 30th. An even better deal came up later that year when FNBO Direct offered 6.00% APY on its new internet savings account until September 28th. The only problem with FNBO Direct was that it was a new internet bank which had many problems, and that angered many Bank Deal readers.

A top rate with a rate guarantee is a nice way for new internet banks to get noticed. That’s what CNB Bank Direct did in 2008 when it offered a 4.00% APY on its no-minimum online savings account and guaranteed that rate for the first 6 months of account opening. One thing we learned with CNB Bank Direct is that you can’t assume internet banks will keep their rates competitive. CNB Bank Direct kept their rates competitive for a couple of years after this promo, but the rates kept falling, and its savings account now has a pathetic rate of 0.21%.

Not all of the best savings account promotions had rate guarantees. Some of the best deals offered a cash bonus. One noteworthy one was at WT Direct which offered a bonus of up to $500 for new deposits in its online savings account.

Past CD Deals

If we had an award for the institution that has offered the most and the best CD promotions since this blog started, I would give PenFed the prize. PenFed has consistently offered great CD deals. Back in early 2007, PenFed offered CDs with a 6.25% APY for terms from three to seven years. Then when this awful interest rate environment was well entrenched in late 2010, PenFed offered a 5% CD. It had a very long term of 10 years and it wasn’t advertised to everyone, but it offered savers a CD rate that hadn’t been seen since 2008. This year it seemed PenFed would never get back to its good old days with top CD rates, but it pleasantly surprised many of us in November with a 2.02% APY 3-year CD and this month with a 3.04% APY 5-year CD.

Reward Checking Accounts

Reward checking accounts first began to be introduced in the early days of the Bank Deals Blog. My first report on a reward checking account was in September 2006. A small Arkansas bank was offering a checking account with a 6.01% APY for balances up to $25,000 if certain monthly requirements (like 10 debit card purchases) were met. The popularity of these accounts exploded in 2007. During the years from 2007 to 2009 I was reporting on a new reward checking account every other day.

The best reward checking account deals came out in 2007 from institutions like State Bank of Toledo and First Arkansas Bank and Trust which offered rates close to 6.00% with no balance caps. As we know, this didn’t last. Rates fell and balance caps were introduced. However, after seven years, hundreds of banks and credit unions continue to offer reward checking accounts with rates higher than what you can get from internet savings accounts. All have balance caps, but many still have caps of $25,000 which still makes the reward checking accounts worthwhile for many savers.

Past Bank Failures

When I first started the Bank Deals Blog, bank failures were rare. In fact, there were no bank failures in 2005 and 2006, and there were only three failures in 2007. That changed with the start of the financial crisis in 2008. The number of bank failures went from 25 in 2008 to 157 in 2010, the peak year.

One of the first bank failures that I reported on was the closure of Netbank in 2007. This bank was closed in September 2007, and the FDIC arranged for ING DIRECT to assume insured deposits. Many Netbank customers who had deposits over the FDIC limit lost money.

It was common for those with uninsured deposits to lose money at failed banks, but that changed after IndyMac Bank failed in July 2008. It failed right before the financial crisis reached its peak, and the FDIC began arranging purchase agreements that required the acquiring banks to assume all deposits of failed banks. Thus, the large majority of banks that failed after IndyMac did not cost depositors any money, even if they had balances over the insured limits. The main worry for depositors was the loss of the high CD rates since the acquiring banks were allowed to lower the interest rates on existing CDs.

The largest bank failure in U.S. history occurred during the financial crisis when WaMu failed and was acquired by Chase. This failure was bad news for WaMu shareholders, but it had little impact on WaMu depositors. In fact, depositors were able to get top CD rates at WaMu for several weeks after the Chase acquisition. Eventually, those deals ended and rates plummeted as Chase transitioned WaMu into its banking system.

There were also failures of institutions that pretended to be banks. One interesting case was the Caribbean-based Millennium Bank. This "bank" advertised heavily on the internet with unusually high CD rates. I reviewed this "bank" in 2005 and warned of several red flags. It turned out to be a ponzi scheme. It was shut down by the SEC in 2007.

Favorite Past Deals? Future Wants? Predictions?

Don’t forget to comment about your past favorite deals that you learned about from DepositAccounts.com. In addition to deals, how has DepositAccounts.com helped you with your savings? Also, we don’t want to rest on our laurels. Are there any improvements you would like to see at DepositAccounts.com?

And finally, do you have any predictions about interest rates or the banking industry eight years from now when we will hopefully be nearing our 20,000th post?

I thought it would be fun to include a poll that asks what will be the rate of the top internet savings account eight years from now. Will we see those 5% savings account rates again?

Financial Planner vs. Financial Advisor: Is There a Difference?

Financial Planner vs. Financial Advisor: Is There a Difference? Step-Up CDs: What They Are and How They Work

Step-Up CDs: What They Are and How They Work What Is a Rollover IRA? Understanding Rollover Rules

What Is a Rollover IRA? Understanding Rollover Rules CD Early Withdrawal Penalty: Should You Pay It?

CD Early Withdrawal Penalty: Should You Pay It?